Jean-Charles Bricongne, Juan Carluccio, Lionel Fontagné, Guillaume Gaulier, Sebastian Stumpner 27 July 2022

We all know from the seminal contribution of Gabaix (2011) that adjustments within the efficiency of some very massive companies matter for combination outcomes in granular economies. The ‘micro to macro’ method, linking micro behaviour to macro outcomes, has significantly superior our understanding of macro aggregates similar to enterprise cycles, comparative benefit (Gaubert and Itskhoki 2020), and the worldwide transmission of shocks (Di Giovanni et al. 2012).

Since adjustments within the efficiency of those massive companies matter for the macroeconomy, it’s paramount to grasp their roots. Why do massive companies carry out in a different way than smaller ones? Whereas the literature has targeted on the function of idiosyncratic shocks (Kramarz et al. 2019), a complementary view poses that giant companies have differential reactions to frequent shocks affecting all companies. This method posits that macro shocks result in heterogeneous reactions, specifically by the most important companies, which in flip decide the macro response to the preliminary shock – i.e. from macro to micro to macro. In a current paper (Bricongne et al. 2022), we analyse the contribution of the most important exporters to combination export fluctuations over a protracted interval, spanning 1993 to 2020. We depend on the universe of detailed firm-level export information collected by the French Customs workplace, containing export values by the vacation spot nation at finely outlined product codes and, crucially, accessible at a month-to-month frequency.

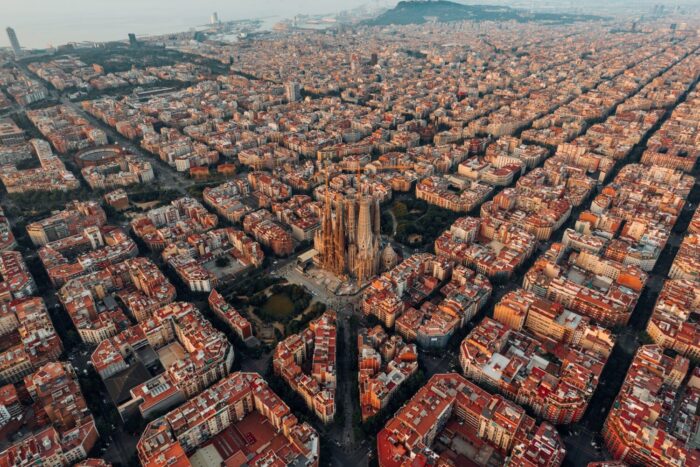

In Determine 1, we decompose combination export progress (on the quarterly frequency for the sake of readability) into an unweighted common of agency export progress price and a granular residual. The latter captures the covariance between agency measurement and agency progress. If the response to macro shocks have been uncorrelated with agency measurement, then the granular residual can be zero. The granular residual is just not zero, and, moreover, it explains a big share of combination export fluctuations: 42% of the variance of combination export progress. Furthermore, the correlation coefficient between unweighted common agency progress and the granular residual is near 0.5. This means that giant exporters are likely to do worse than the common agency in instances of downturn and higher than common in instances of upturn.

Determine 1 Common agency export progress and the granular residual

Be aware: The mid-point progress price of combination quarterly French exports is decomposed into the unweighted common progress price throughout persevering with exporters (blue line) and the covariance between exporter measurement and the unweighted progress price (the granular residual, crimson line).

Giant exporters drove the export collapses within the World Disaster and the pandemic

The overreaction of enormous companies to macro shocks is sizeable and clearly seen within the case of the 2 largest macro international shocks of the previous a long time, during which the collapses of French exports have been of comparable magnitude (-17.4% for 2009/2008 and -16.3% for 2020/2019). Not solely are the 2 export collapses nearly fully defined by the intensive margin (companies that proceed to export), however they have been additionally brought on by the most important exporters, whose export progress charges have been considerably decrease than these of the common exporter.

We illustrate this in Determine 2, the place we plot weighted common year-on-year mid-point progress charges by non-overlapping measurement bins of exporters. Dimension bins are outlined utilizing the pre-crisis exporter measurement distribution (2019 for Covid and 2008 for the World Disaster). Development charges have been cleaned of composition results when it comes to the sectoral and geographical profiles of firm-level exports and thus calculated as the expansion of exports inside finely outlined markets. The highest 0.1% exporters (roughly 100 companies out of 100,000) are represented by the crimson line.

The message is clear-cut: progress of the highest exporters declined considerably greater than the common exporter, controlling for composition results when it comes to sectors and locations. This sample holds in each crises. Apparently, in each occasions, the most important exporters additionally skilled a slower restoration than these within the backside 90%.

Determine 2 Development charges of exports through the Covid disaster (left) and World Disaster (proper), by measurement bin

Be aware: 12-month weighted common mid-point progress charges by decile of the exporter measurement distribution. Exporter measurement bins are outlined utilizing the pre-crisis distribution export measurement distribution (complete firm-level exports in 2019 within the case of Covid and complete firm-level exports in 2008 for the World Disaster).

We zoom in on the export collapse of April and Might 2020 in Determine 3. Given the big focus of exports, we select significantly wonderful bins on the prime of the distribution. For example, the highest 1% (roughly 1,000 companies) account for over 70% of complete exports. The black bars present the share of combination exports in April and Might 2019 accounted for by every measurement bin.

We then examine the pre-crisis export share of every bin with its contribution to the combination export collapse between April and Might 2019 and April and Might 2020, measured because the change in complete exports of a bin divided by the change in combination exports. If all companies grew on the identical price, the contribution of every bin would equal its pre-crisis share. The determine exhibits that the small group of ‘famous person’ exporters disproportionately clarify the hunch in exports. The highest 0.1% of exporters contributed 57% to the collapse in combination exports, whereas their pre-crisis share was solely 41%. Throughout the prime 0.1%, the ten largest exporters alone account for round one-third of the export collapse, whereas they exported 19% of the whole pre-crisis values. The message is identical as in Determine 1. The unfavorable relationship between pre-crisis measurement and export adjustment to the disaster additionally holds inside the set of 1,000 bigger exporters.

Determine 3 Export share in 2019 Covid and contribution to 2019-2020 commerce progress, by measurement bin

Be aware: Pre-crisis export share and contribution to the combination export collapse between April and Might 2019 and April and Might 2020. Exporter-size bins are constructed utilizing the 2019 export worth by companies.

The 2020 collapse of French exports was pushed by demand shocks; international worth chain disruptions performed a lesser function

The Covid-19 pandemic offers us with a wonderful laboratory to review the function of heterogeneous reactions to combination shocks. The shock was sudden and exogenous. Whereas sanitary measures have been imposed in most French commerce companions, their timing provide variation that we will exploit, due to the month-to-month frequency information, to measure each provide and demand shocks.

Giant companies are certainly extra more likely to be extra engaged in complicated international worth chains (GVCs) (Antras 2020) and extra doubtless uncovered to provide disruptions brought on by systemic shocks (Baldwin and Freeman 2022). Our purpose is to grasp whether or not the bigger GVC publicity of prime exporters can clarify their stronger response to the shock, not whether or not GVCs are essential per se. We complement the export information with info on firm-level imports and gross sales and measure the GVC publicity of every exporter with the ratio of imported intermediate inputs to gross sales (IIS ratio) and provide shock publicity utilizing the knowledge on lockdowns within the origin international locations of imports. We develop a versatile regression framework that relates progress charges in every market (outlined as a product-destination pair) to measurement bin dummies. The info reveal that including GVC measures to our regressions doesn’t have an effect on the magnitude and significance of the exporter size-bin dummies. In different phrases, the overreactions of enormous exporters weren’t resulting from their deep engagement in GVCs.

In distinction, we do discover convincing proof of a requirement channel which isn’t pushed by the sector or vacation spot composition of exporters. As an alternative, we estimate a bigger elasticity of enormous companies to destination-country lockdowns. Specifically, we regress the midpoint progress price on the firm-product-country-month stage on the Oxford Stringency Index (Hale et al. 2021) in every origin nation every month. Identification exploits variation in export progress of the identical agency throughout locations with various levels of lockdowns, absolutely controlling for product-level shocks. The regression absolutely controls for firm-level provide shocks, originating each in France and overseas, by together with agency*month mounted results. The outcomes are proven in Determine 4. On common, going from full to no lockdown diminished the midpoint progress charges by 0.6 factors. Nevertheless, the impact is strongly heterogeneous, being nearly double for companies within the prime 0.1% with (1.0) with respect to the underside 99.99% (beneath 0.5).

Determine 4 Impact of vacation spot lockdown by measurement bin

Be aware: Lockdown stringency is interacted with a set of six complementary measurement dummies, in a regression together with firm-month, product-month, and vacation spot mounted results. The dependent variable is the mid-point progress price of exports by agency, product and vacation spot nation throughout a given month. We plot level estimates and 1% confidence intervals.

Figuring out the function of enormous companies for macroeconomic aggregates is a energetic and critically essential space of analysis. It has a wide range of implications for the framing of financial insurance policies (see, for instance, an software to imports of Russian gasoline, Lafrogne-Joussier et al. 2022). Our outcomes present that the response of combination exports to massive macroeconomic shocks is basically pushed by the big weight of enormous companies within the economic system and their higher sensitivity to those shocks. The very excessive contribution of export champions to business success could thus flip right into a vulnerability within the occasion of a sudden downturn within the enterprise cycle.

References

Antras, P (2020), “Conceptual facets of world worth chains”, World Financial institution Coverage Analysis Working Paper 9114.

Baldwin, R and R Freeman (2022), “World provide chain threat and resilience”, VoxEU.org, 6 April.

Bricongne J C, J Carluccio, L Fontagné, G Gaulier and S Stumpner (2022), “From Macro to Micro: Giant Exporters Dealing with Widespread Shocks”, Financial institution of France Working Paper 881.

Di Giovanni, J, A Levchenko and I Méjean (2012), “The function of companies in combination fluctuations”, VoxEU.org, 16 November.

Di Giovanni, J, A Levchenko and I Méjean, (2020), “Overseas shocks as granular fluctuations”, Bureau of Financial Analysis Working Paper 28123.

Gabaix, X (2011), “The granular origins of combination fluctuations”, Econometrica 79(3): 733-772.

Gaubert C and O Itskhoki (2020), “Celebrity companies and the comparative benefit of nations”, VoxEU.org, 14 August.

Hale, T, N Angrist, R Goldszmidt, B Kira, A Petherick, T Phillips, S Webster, E Cameron-Blake, L Hallas, S Majumdar and H Tatlow (2021), “A world panel database of pandemic insurance policies (Oxford COVID-19 authorities response tracker)”, Nature Human Behaviour 5: 529–538.

Kramarz, F, J Martin and I Méjean (2019), “Idiosyncratic dangers and the volatility of commerce”, VoxEU.org, 11 December.

Lafrogne-Joussier, R, A Levchenko, J Martin and I Méjean (2022), “Past macro: Agency-level results of slicing off Russian vitality”, VoxEU.org, 24 April.