From a brand new guide from Cambridge:

On this newly printed quantity, Yin-Wong Cheung

“discusses the worldwide function of the RMB. After recapitulating its financial and commerce progress experiences, we recount China’s evolving alternate price coverage within the post-reform period, evaluation the talk over whether or not the RMB is overvalued or undervalued, current China’s insurance policies to globalize the RMB, describe offshore RMB buying and selling, assess the present world standing of the RMB, and focus on geopolitical tensions in the previous couple of years. Since 2009, the method of globalizing RMB has not been clean crusing and has progressed fairly erratically over time. Regardless of the sturdy efficiency within the early 2010s, the RMB is underrepresented within the world market and its world function doesn’t match China’s financial may. The trail of RMB internationalization is affected by each China’s financial efficiency and

geopolitical elements.”

Concerning RMB internationalization, Cheung notes:

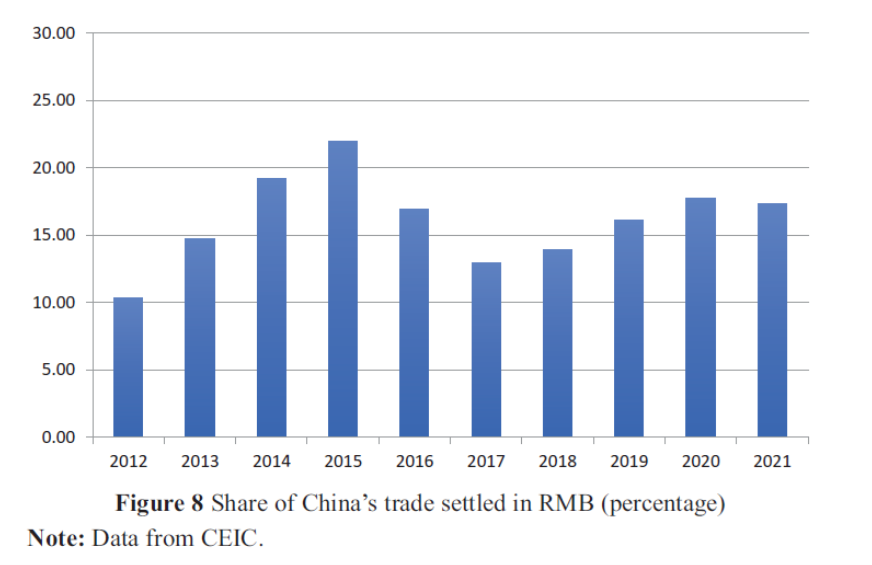

After reaching the 2015 excessive level, the method of globalizing the RMB has progressed fairly erratically and, in some areas, has even reversed. The change occurred in parallel with China’s heightened (administrative) international alternate administration, financial deleveraging insurance policies, and the concurrent enhance in world uncertainty and geopolitical tensions which have decreased world demand for RMB-denominated belongings. Additional, the eruption of the China-US commerce dispute and the next change within the view towards China don’t favor the worldwide use of the RMB. The 2020 coronavirus pandemic offered China with one other probability to regain the momentum of globalizing its foreign money. The pandemic impacted China onerous within the first half of 2020; nevertheless, with its efficient public well being management measures, China demonstrated its financial resilience in late 2020 and 2021.32 This speedy financial restoration and the RMB’s stability have improved the attractiveness of RMB-denominated belongings to worldwide buyers and enhanced the worldwide utilization of the RMB.

Within the following subsections, we recount China’s most important insurance policies for promotion of RMB internationalization and focus on its outsourcing follow – the offshore RMB buying and selling. China’s RMB internationalization program covers and interacts with a variety of subjects. Whereas an entire protection of RMB international-ization is past the scope of this examine, we provide an outline.

Supply: Cheung (2022).

Any scholar wishing to comply with China’s insurance policies concerning its alternate price should learn this quantity.

My ideas on earlier essays on China’s foreign money embrace Eswar Prasad’s Gaining Forex (2015), Paulo Subacchi’s The Individuals’s Cash (2017). My take on the RMB’s standing relative to the greenback was offered at a latest Board-NY Fed convention.

If the creator’s title sounds acquainted, he (together with myself and Eiji Fujii) coauthored The Financial Integration of Better China (2007) (we’re engaged on an replace now), a number of works on RMB misalignment (most just lately, Cheung, Chinn and Xin, 2017), alternate price prediction (most just lately Cheung, Chinn, Garcia Pascual, Zhang, 2019), and on Chinese language imports and exports (Cheung, Chinn, Qian, 2015).