At the moment, we’re happy to current a visitor contribution by Steven Kamin (AEI), previously Director of the Division of Worldwide Finance on the Federal Reserve Board. The views introduced characterize these of the authors, and never essentially these of the establishments the authors are affiliated with.

In latest months, there was a substantial amount of dialogue within the monetary media about how aggressive Fed tightening has pushed up the greenback and poses (a minimum of) two harmful consequence for the worldwide economic system. First, larger U.S. rates of interest and a stronger greenback are creating difficulties for rising market economies (EMEs), which should purchase {dollars} to repay their greenback money owed with cheaper native currencies. And, second, these cheaper currencies, in superior in addition to rising market economies, are boosting import prices, including to already-strong inflationary pressures, and forcing international central banks to tighten their very own financial insurance policies. Each these developments purportedly are pushing the world into international recession.

There’s some reality to those considerations. A rising greenback is likely one of the channels via which U.S. financial coverage tightening helps cool the economic system, and this inevitably includes exporting a specific amount of our inflation to different economies. Additionally it is true that, traditionally, tighter Fed insurance policies have meant dangerous information for EMEs: plunging currencies, rising credit score spreads, and disruptive capital outflows.

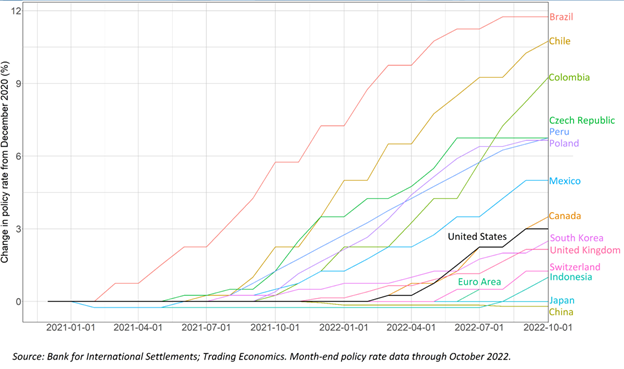

Nevertheless, as I discover in my latest observe, Will the Sturdy Greenback Set off a International Recession, a lot of the present dialogue exaggerates the position of Fed tightening and greenback appreciation in darkening prospects for the world economic system. First, opposite to the impression conveyed by many commentators that the Fed has been exceptionally aggressive, central banks in lots of nations began tightening financial coverage earlier than the Fed and most of them raised charges by an awesome deal extra.

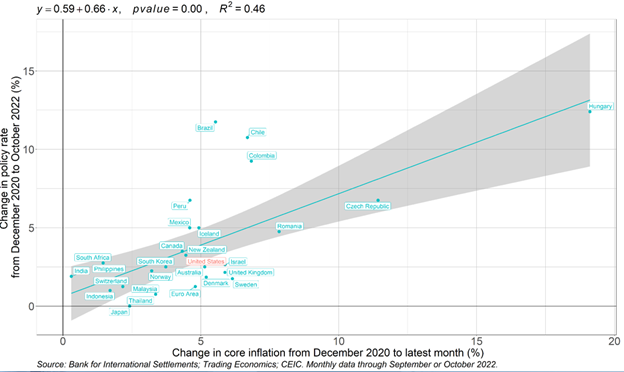

Nations with bigger will increase in core inflation (excluding meals and vitality) usually carried out bigger will increase in rates of interest—the Fed’s response to inflation has been very a lot consistent with that relationship.

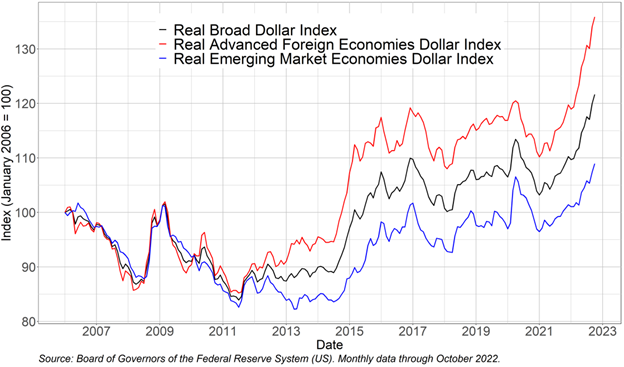

Second, the robust greenback is placing much less strain on EMEs than is mostly believed. Most discussions of this difficulty concentrate on the greenback’s worth in opposition to the currencies of the superior economies. Even after giving up a few of its positive aspects previously week, that is up about 15 % because the starting of 2021, based mostly on Federal Reserve knowledge. Against this, the worth of the greenback in opposition to the currencies of our EME buying and selling companions is up solely about 8 % over the identical interval.

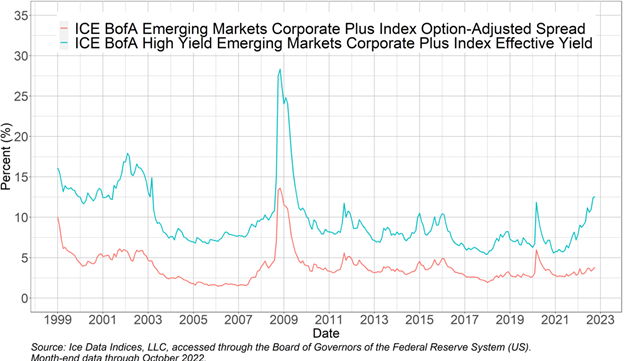

This smaller rise within the greenback in opposition to the EMEs interprets right into a smaller rise of their debt burden. Certainly, thus far this 12 months, many of the main EMEs have held up moderately effectively. As proven under, credit score spreads over U.S. Treasuries on greenback debt owed by EMEs, an excellent measure of the market’s evaluation of their creditworthiness, have widened on common however usually stay with historic ranges. To make certain, high-yield spreads for particularly fragile economies, comparable to Sri Lanka, Pakistan, and Argentina, are rising extra, however these largely replicate their very own basic imbalances and, in any occasion, are unlikely to tug the worldwide economic system into recession.

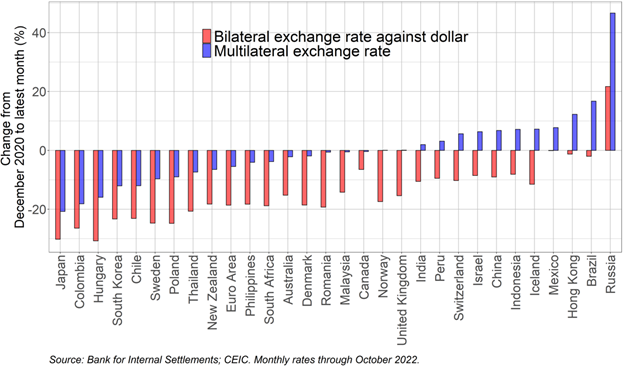

Lastly, the position of the robust greenback in boosting inflation overseas has been exaggerated. As a result of almost all currencies have fallen in opposition to the greenback, every international economic system’s “multilateral change price”—that’s, its common change price in opposition to all of its buying and selling companions—has fallen by a lot much less (and even risen) than its “bilateral” price in opposition to the greenback. In consequence, the international economies skilled smaller will increase in import prices and thus shopper costs than could be implied by the depreciations of their currencies in opposition to the greenback alone. (Along with imports from america, commodity costs comparable to oil are additionally invoiced in {dollars}, however their costs usually fall when the greenback rises.) And which means that international central banks have needed to tighten financial coverage by much less.

Summing up, the rise within the greenback poses challenges for the worldwide economic system, however these challenges shouldn’t be overstated. A slim concentrate on the robust greenback underplays what are undoubtedly the extra salient forces pushing the world economic system towards recession: elevated vitality and meals prices; vitality shortages, particularly in Europe, ensuing from Russia’s invasion of Ukraine; hovering inflation charges prompting central banks world wide to tighten financial coverage; China’s growth-strangling zero-COVID coverage; and financial scarring and debt buildups left because the legacy of the COVID-19 pandemic.

This publish written by Steven Kamin.