EU officers assault Joe Biden over sky-high fuel costs, weapons gross sales and commerce as Vladimir Putin’s battle threatens to destroy Western unity.

…“The actual fact is, if you happen to have a look at it soberly, the nation that’s most benefiting from this battle is the U.S. as a result of they’re promoting extra fuel and at greater costs, and since they’re promoting extra weapons,” one senior official advised POLITICO. ”

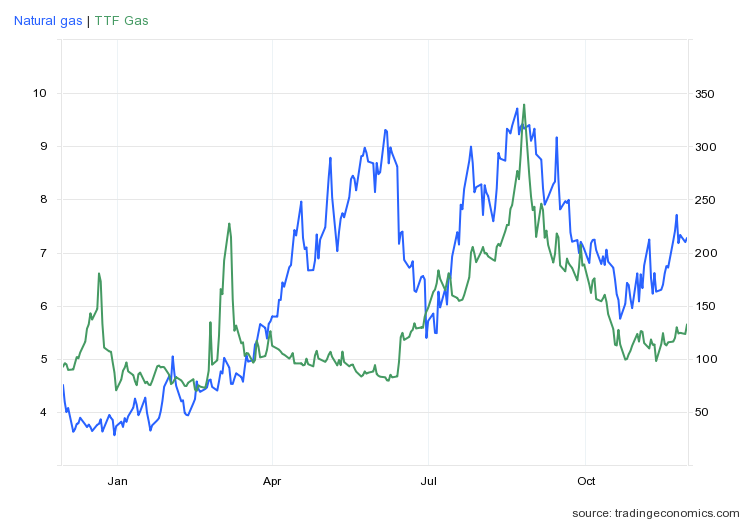

Whereas the quote is taken verbatim from Politico, it’s not clear to me that pure fuel costs are sky-high within the European context. Listed here are information for US pure fuel futures (blue line) vs. Dutch TFF futures (inexperienced line).

Determine 1: US pure fuel, USD/MMbtu, (blue, left scale), and TTF pure fuel, EUR/MWh (inexperienced, proper axis). Supply: Tradingeconomics.com, accessed 11/29/2022.

Costs are quoted in numerous models (Eur/MWh for TTF, USD/MMbtu for US), so a direct comparability shouldn’t be attainable. Nonetheless one can see TTF costs are a lot under what they have been earlier within the 12 months (though a lot greater than they have been two years in the past).

What about LNG. Right here, as I’ve famous, markets are segmented due to capability for transport and for conversion from liquid to fuel kind. EIA notes for the week ending 11/16:

Worldwide pure fuel futures value actions have been combined this report week. Based on Bloomberg Finance, L.P., weekly common futures costs for liquefied pure fuel (LNG) cargoes in East Asia decreased 85 cents to a weekly common of $27.06/MMBtu, and pure fuel futures for supply on the Title Switch Facility (TTF) within the Netherlands, probably the most liquid pure fuel market in Europe, elevated 15 cents to a weekly common of $34.10/MMBtu.

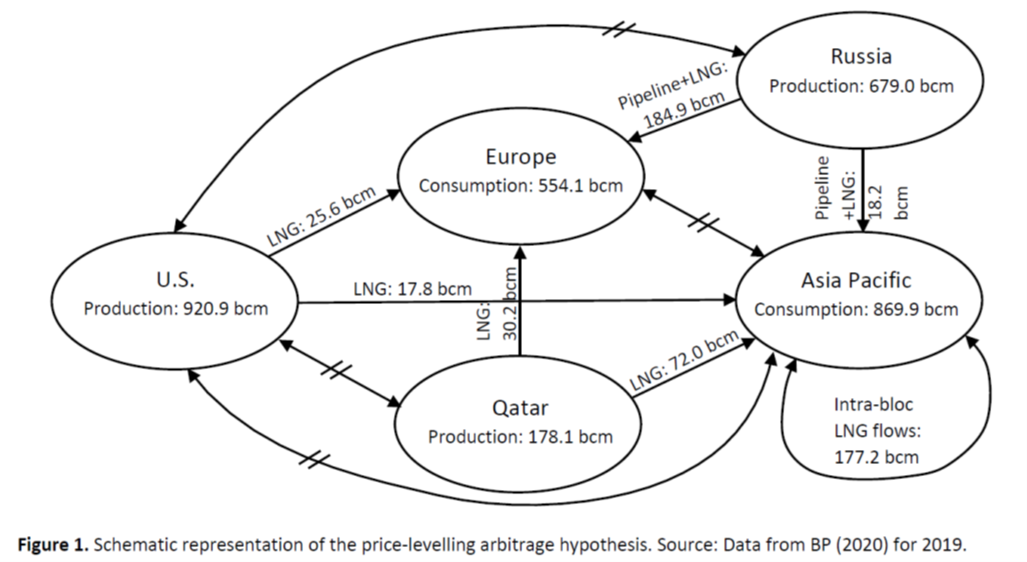

Is that this to be anticipated (versus whether or not this can be a “good” or “honest” consequence)? I’d say sure, given what we all know in regards to the market (see this publish). The quote within the publish is from Loureiro et al. (2022):

…[T]his examine conducts progress convergence testing and clustering evaluation on a panel comprised of 4 established fuel value benchmarks and two rising ones that develop as much as the pre-Covid-19 interval. Essentially the most important discovering is that no fuel value convergence will be discovered outdoors Europe. That is regardless of the existence of episodes of partial convergence which can be recognized within the literature, and replicated and defined right here. Importantly, the outcomes strongly reject the idea that elevated LNG flows function a price-levelling arbitrage mechanism.

As soon as one sees the relative magnitudes of flows just a few years earlier, one can see why value equalization can be unlikely.

Supply: Loureiro et al. (2022)

* If you happen to have been questioning, sure, this is identical JohnH who has bother figuring out the place median actual earnings information are situated, what ONS information is reported, and doubts Ukrainian strikes to take Kherson.