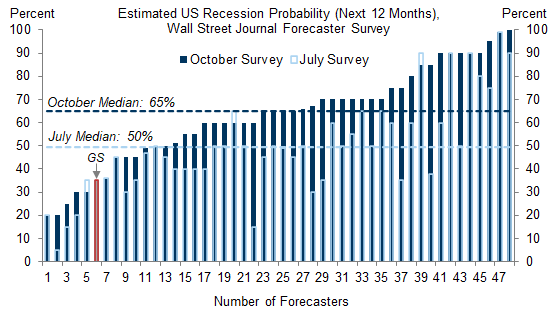

From M. Abecasis/GS right this moment:

Supply: M. Abecasis, “Introducing Our Recession Watch Tracker,” U.S. Each day, Goldman Sachs, December 2, 2022.

The 35% determine contrasts with the 65% consensus from the October WSJ survey, and, the 50-50 likelihood by the Fed employees, and my time period unfold primarily based estimates between 44%-56%. I discovered it attention-grabbing why, partly, they low cost the estimates from normal time period unfold fashions:

When monetary market members see the next likelihood of recession, they’re extra prone to anticipate the FOMC to chop the federal funds price to stimulate the economic system. We’re skeptical that conventional yield curve fashions will produce smart recession odds within the present setting, because the Fed is prone to be extra reluctant to ease coverage for a given set of progress and employment outcomes when inflation is excessive. However whereas quantifying recession possibilities primarily based on historic expertise is prone to produce deceptive outcomes, the connection between the coverage price and progress nonetheless makes market pricing for the funds price a helpful sign of expectations for the chances and timing of a possible recession. At present, the bond market is pricing hikes by 2023Q2, however 42bp of cuts in 2023H2 (vs. 33bp on the finish of October), 87bp of cuts in 2024H1 (vs. 50bp), and 57bp of cuts in 2024H2 (vs. 31bp).

Right here’s the image of 10yr-3mo and 10yr-2yr time period spreads as of shut right this moment:

Determine 2: 10 year-3 month Treasury time period unfold (blue), and 10 year-2 12 months unfold (pink), %. Supply: US Treasury, writer’s calculations.

Each spreads at the moment are firmly in unfavorable territory. My newest estimates (for knowledge by Nov 23) right here.