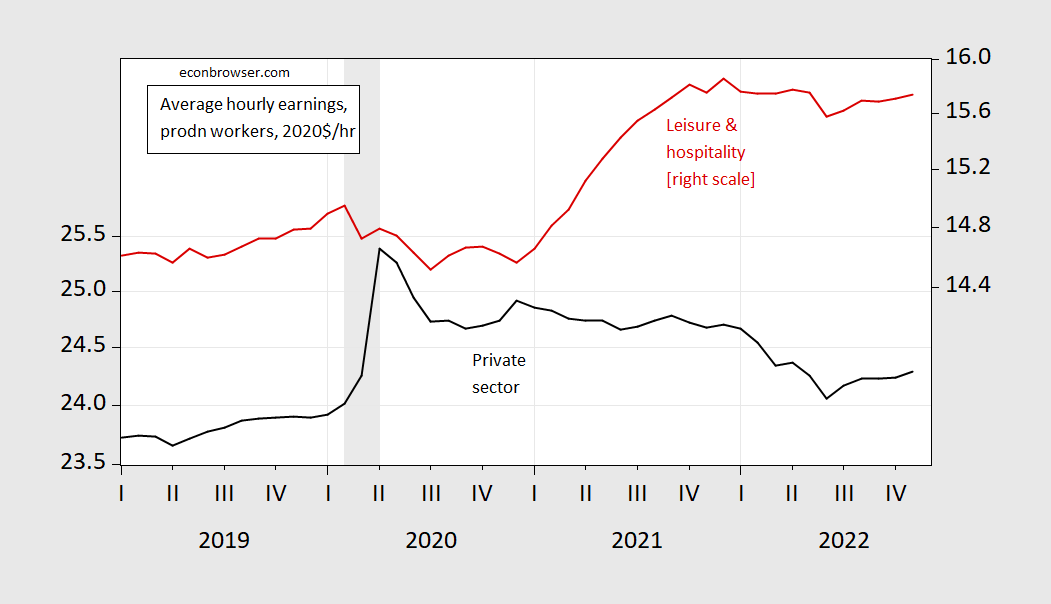

Whereas current accounts have targeted on the erosion of actual wages with excessive inflation, what’s true is that common actual wages within the non-public sector, and amongs the bottom paid phase, leisure and hospitality employees, has risen since 2020M02.

Determine 1: CPI-deflated actual wage in non-public sector (black, left log scale), and in leisure and hospitality (purple, proper log scale), in 2020$/hour (manufacturing and nonsupervisory employees). November CPI utilizing Cleveland Fed nowcast on 12/4/2022. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS by way of FRED, NBER, and writer’s calculations.

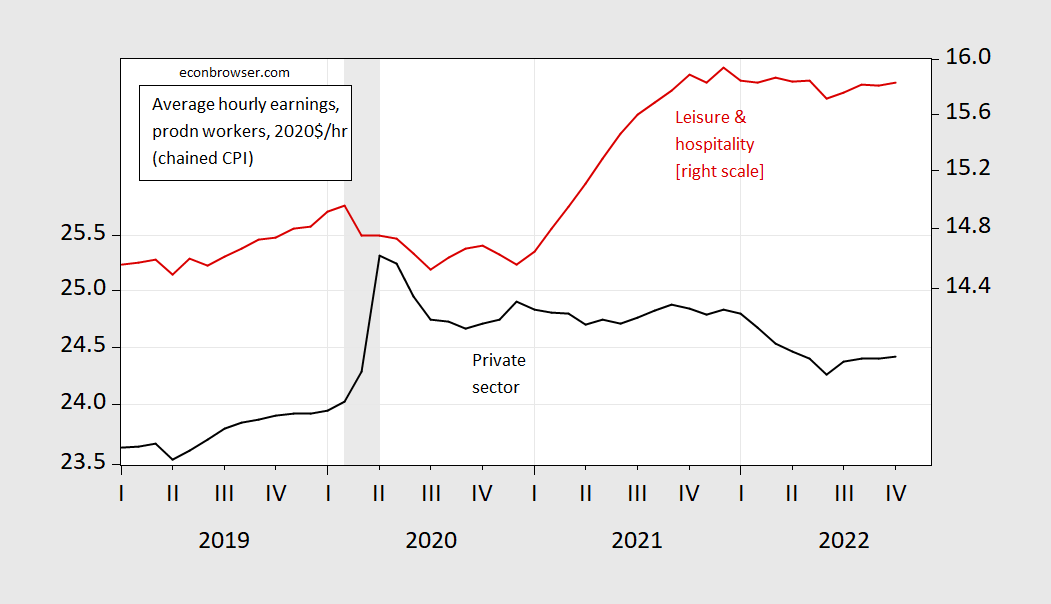

Determine 2: Chained CPI-deflated actual wage in non-public sector (black, left log scale), and in leisure and hospitality (purple, proper log scale), in 2020$/hour (manufacturing and nonsupervisory employees). Chained CPI seasonally adjusted by writer utilizing Census X-11 on log remodeled information. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS by way of FRED, NBER, and writer’s calculations.

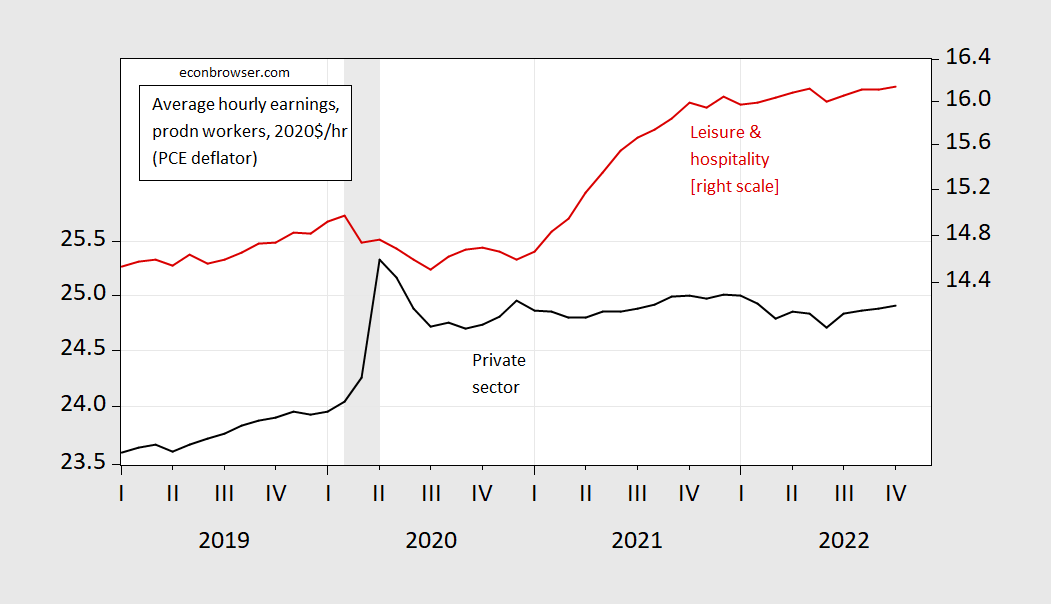

Determine 3: PCE-deflated actual wage in non-public sector (black, left log scale), and in leisure and hospitality (purple, proper log scale), in 2020$/hour (manufacturing and nonsupervisory employees). NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS by way of FRED, NBER, and writer’s calculations.

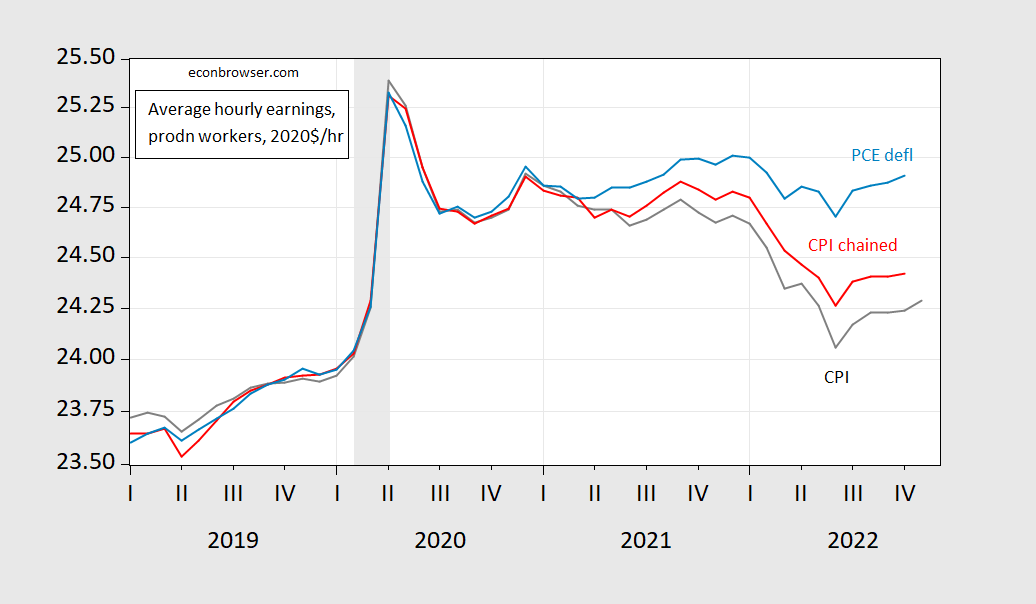

These graphs spotlight the significance of deflators. Here’s a comparability of complete non-public sector common hourly earnings for manufacturing and nonsupervisory employees:

Determine 4: CPI-deflated actual wage in non-public sector (darkish grey), chained CPI (purple), PCE deflated (mild blue), in 2020$/hour (manufacturing and nonsupervisory employees). November CPI utilizing Cleveland Fed nowcast on 12/4/2022. Chained CPI seasonally adjusted utilizing Census X-11 on log remodeled information. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS by way of FRED, Cleveland Fed, NBER, and writer’s calculations.

For an outline of the empirically related variations between CPI and PCE value deflator, see Johnson (2017). Because the CPI takes under consideration out of pocket bills, whereas the PCE deflator takes under consideration expenditures made for shoppers, the variations may be giant. House owners equal lease and lease of major residence constitutes a giant distinction within the weights related to the CPI and PCE deflator.

Addendum:

There’s some motive to fret in regards to the 2022M11 remark on wages, because the response fee was lower than 50%, when it’s sometimes a lot larger.