I begin educating a pair lessons tomorrow; listed below are some cautionary notes.

From the first version:

Forgetting whether or not nominal or actual magnitudes are extra essential

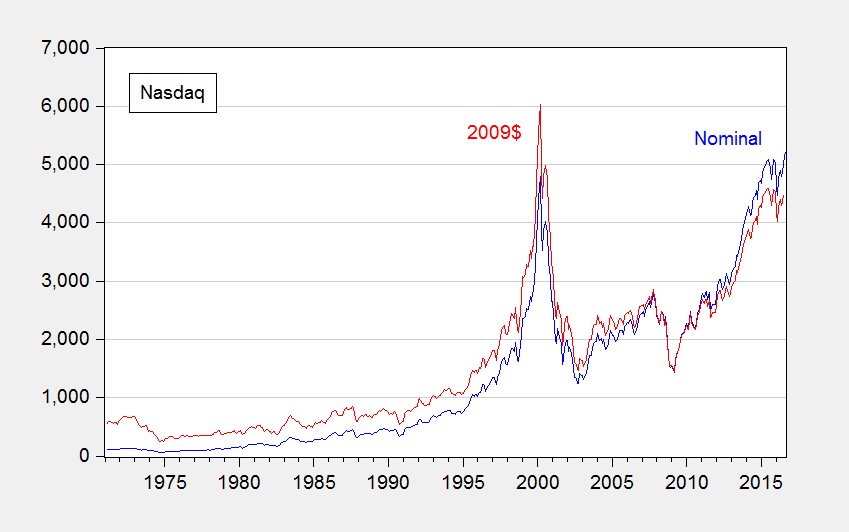

Usually we hear of data being damaged. However there are data and there are data. As an example, contemplate this headline: Nasdaq and S&P 500 Climb to Information. The assertion is right, nevertheless it’s missing in context to the extent that the actual, or inflation adjusted, value is extra related (provided that share costs characterize valuations of a declare to capital).

Determine 1: Nasdaq (blue), and CPI-deflated (pink), in 2009$. Supply: NASDAQ through FRED, BLS, and creator’s calculations.

Now, some individuals proof wariness about deflation, significantly by way of the accuracy of the deflators. Nevertheless, it’s often higher to account for value degree results and word the issues, somewhat than depend on individuals to maintain their most popular deflators of their head to calculate the true magnitudes (see this publish).

Including up chain weighted portions

Whereas in lots of instances, actual magnitudes are the related ones, working with actual magnitudes will not be at all times easy. As an example, in precept, if one had information on actual consumption by households in Wisconsin and family in Minnesota, and one needed so as to add them as much as discover actual consumption in Wisconsin and Minnesota, one may try this by deflating every state’s consumption by the CPI and including. That’s true as a result of the CPI is basically a hard and fast base yr weighted index (on this case, a Laspeyres index, utilizing the preliminary weights).

This isn’t true for the sequence within the nationwide earnings and product accounts, such because the parts of GDP. The actual measures – consumption, funding, authorities, internet exports — are obtained utilizing chain weighted deflators, i.e., deflators the place the weights differ over time.

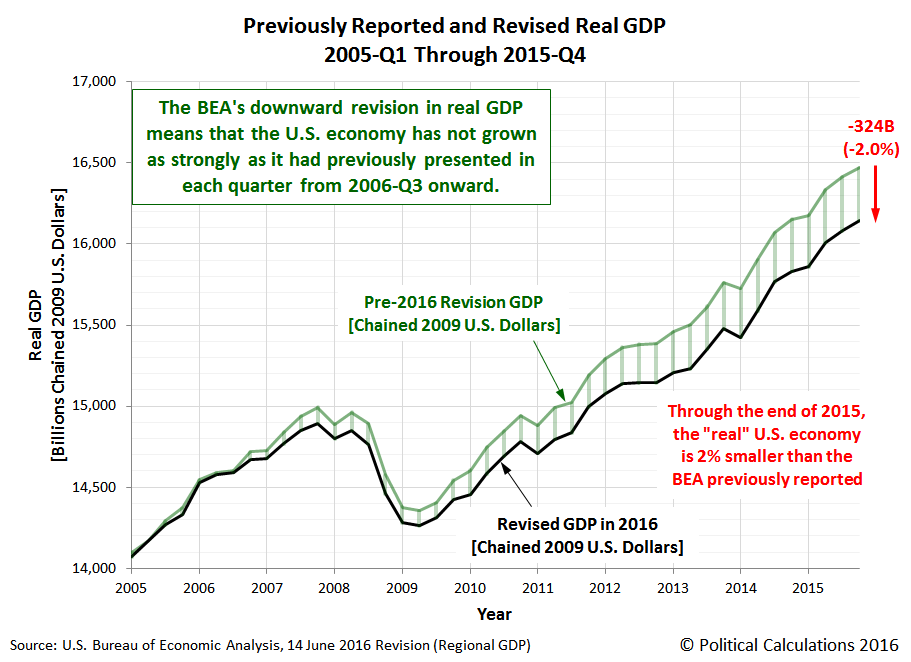

Can one make a mistake this fashion? Definitely. Think about this latest case at Political Calculations, whereby the commentator added up the state degree actual GDPs and since it didn’t match the nationwide degree GDP, the commentator inferred an enormous impending downward revision in GDP.

Supply: Political Calculations.

For sure, the large downward revision didn’t happen. General, actual GDP was revised barely upward. Determine 2 depicts what really transpired.

Determine 2: Actual GDP pre-benchmark revision (inexperienced), post-benchmark revision (pink), and arithmetic sum of state degree GDP (black), all in Ch.2009$ SAAR. Supply: BEA 2016Q1 third launch, 2016Q2 advance launch, BEA state degree quarterly GDP, revision of 27 July 2016, and creator’s calculations.

Extra dialogue in this publish. Now, typically one needs to specific ratios of actual magnitudes. This publish discusses a technique at getting at one thing like that.

Forgetting what “SAAR” means

SAAR is brief for Seasonally Adjusted, at Annual Rates. Most US authorities statistics are reported utilizing this conference, even when the information are at a month-to-month or quarterly frequency. (In distinction, European quarter-on-quarter GDP figures are sometimes reported on a non-annualized foundation.) Most prominently, quarterly GDP is reported at annual charges, so when one sees 18,000 Ch.09$ in 2016Q2, that doesn’t imply the move of GDP was 18,000 Ch.09$ in that quarter; somewhat that if the move that occurred in 2016Q2 continued for an entire yr, then GDP could be recorded at 18,000 Ch.09$.

Now, this doesn’t matter if one is calculating proportion development charges (so long as one additionally remembers to annualize the expansion price if one is calculating quarter-on-quarter modifications). It does matter if one is calculating a “multiplier”, the rise in GDP for a given enhance in authorities spending. That’s as a result of the federal government spending enhance (or stimulus) is usually reported in absolute (non-annualized) charges, and GDP in SAAR phrases. Clearly, if one did the mathematical calculation forgetting this level, one’s multipliers would look 4 occasions as massive as they need to. If compounded with failing to take into consideration annualizing development charges, then they might look sixteen occasions as massive as they need to. Even skilled economists make this error – contemplate the case of this College of Chicago economist, who thought “…the multiplier is 20 or 50 or one thing like that” as a result of he was basically dividing a quarterly stimulus determine by an annualized determine, and forgetting that development charges are usually reported at annualized charges.

What in regards to the “SA” a part of the SAAR? More often than not, one needs to make use of seasonally adjusted sequence; actually, that is virtually at all times what’s reported within the newspapers. The reason being that there’s a massive seasonal part to many financial variables; retail gross sales bounce in December due to the Christmas holidays, as an example.

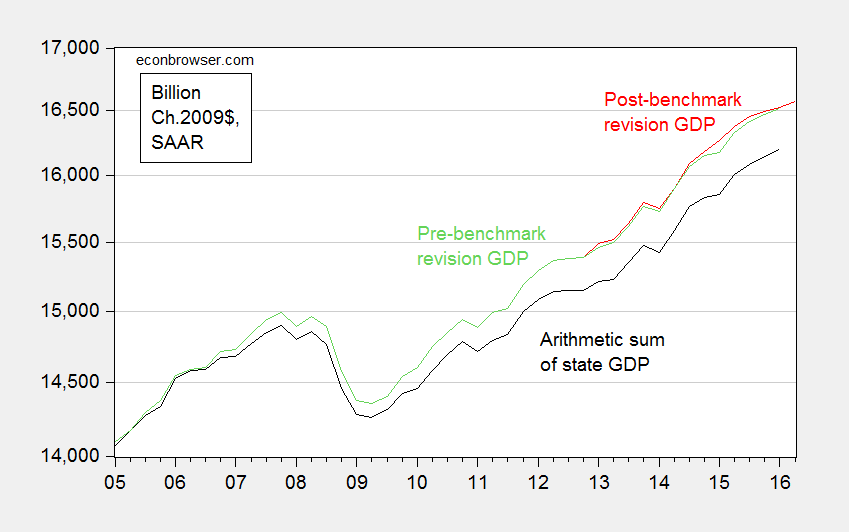

Sometimes, individuals (often noneconomists) get into bother after they combine and match seasonal and non-seasonal information. As an example, Wisconsin Governor Walker’s marketing campaign acquired into bother after they touted job creation numbers obtained by including collectively seasonally unadjusted jobs figures (from what is known as the Quarterly Census of Employment and Wages) with seasonally adjusted jobs figures (from the institution survey) to get a cumulative change in employment. (They did this as a result of QCEW figures lag by many months, whereas the institution survey information are extra well timed). That is proven in Determine 3.

Determine 3: Wisconsin nonfarm personal employment from Quarterly Census of Employment and Wages, not seasonally adjusted (blue), personal nonfarm personal employment from institution survey, seasonally adjusted (pink). Black arrows denote modifications over QCEW and institution survey figures; teal arrows over institution survey. Supply: BLS.

Discover that one can calculate the modifications from December 2010 (simply earlier than Walker takes workplace) to March 2012 (the most recent QCEW figures accessible as of December 12, 2012), after which add to the change from March 2012 to October 2012 (the most recent institution determine accessible as of December 12, 2012). That’s, add 89.1 to six.4 to get 95.5 thousand, near the 100 thousand determine cited by Governor Walker’s marketing campaign. You may see why Governor Walker’s marketing campaign officers did so – the proper calculation utilizing the change within the institution survey from December 2010 to October 2012 was solely 61.1 thousand.

Log aversion

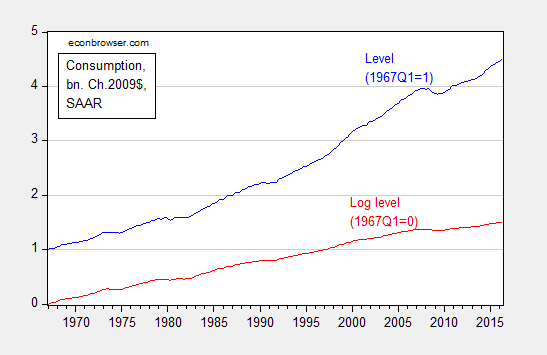

Oftentimes, we depict financial statistics in log phrases. The rationale for that is that when plotted over time, a variable rising at a relentless price will appear to be it’s accelerating if the Y-axis is expressed in degree phrases. Nevertheless, it’ll appear to be a line with fixed slope if the Y-axis is in log phrases.

Determine 4: Actual consumption, normalized to 1967Q1=1 (blue), and log actual consumption, normalized to 1967Q1=0 (pink). Supply: BEA, 2016Q2 second launch, and creator’s calculations.

Solely inspecting the extent sequence, consumption seems to be accelerating, significantly within the 2000’s. That illusory acceleration disappears within the log sequence.

For extra on log transformations, see [1], [2], [3], [4], and [5]. And right here’s Jim Hamilton’s publish on logs. Right here is an instance of the place the usage of logs has pushed somebody to ranting and raving.

Shadowstats and different information conspiracies

It’s not unusual for commentators to allege conspiracies to govern authorities financial statistics. Take this FoxNews article:

What a coincidence. Simply as momentum was constructing in the direction of an rate of interest hike by the Fed, alongside comes a dismal jobs report that takes any enhance off the desk. Opposite to the overall notion, this can be a fortunate break for Democrats. … Given all that’s stake, it’s stunning that nobody has questioned whether or not the roles report may need been massaged by the Labor Division.

In trendy occasions, some of these allegations are unfounded. The information sequence may not be significantly correct, however deliberate manipulation to distort the financial image doesn’t happen for normal sequence launched by the BEA, BLS, and Census.

One significantly egregious type of conspiracy-mongering is Shadowstats, a money-making enterprise that purports to offer a extra correct set of value measurement. As an alternative of going into element, I’ll flip the case over to Jim Hamilton, who completely debunks the Shadowstats method. Anyone who cites Shadowstats ought to instantly lose all credibility. So … don’t do it!

Extra information conspiracies, see right here.

From the second version:

Don’t Motive from identities

Top-of-the-line recognized identities in economics is the definition of GDP:

Y ≡ C + I + G + X – IM

From this, a author on the Heritage Basis deduces the next:

Congress can not create new buying energy out of skinny air. If it funds new spending with taxes, it’s merely redistributing present buying energy (whereas reducing incentives to provide earnings and output). If Congress as an alternative borrows the cash from home traders, these traders may have that a lot much less to speculate or to spend within the personal economic system. In the event that they borrow the cash from foreigners, the stability of funds will modify by equally elevating internet imports, leaving complete demand and output unchanged. Each greenback Congress spends should first come from some other place.

In different phrases, G rising by one greenback essentially reduces both C or I by one greenback. After all, that is true holding Y mounted. There isn’t any cause why this could essentially be true. One can’t say what occurs with out a mannequin.

The creator provides in one other id, the stability of funds, for good measure:

BP ≡ CA + FA + ORT

The place CA is the present account (roughly the commerce stability, X-IM), FA the personal monetary account, and ORT official reserve transactions. FA going up by one greenback outcomes essentially in CA declining by one greenback within the creator’s most popular interpretation. After all, his holds ORT fixed (no modifications in international change reserves). And it guidelines out repercussion results, such that offsetting lending happens…

In different phrases, there isn’t any solution to keep away from utilizing some form of mannequin when one needs to impute trigger and impact. It doesn’t need to be mannequin with equations, but when one tries to keep away from utilizing a mannequin, one finally ends up implicitly utilizing a mannequin, that as a rule, has inner inconsistencies, or implausible assumptions.

Don’t Overlook to Test for Knowledge Breaks

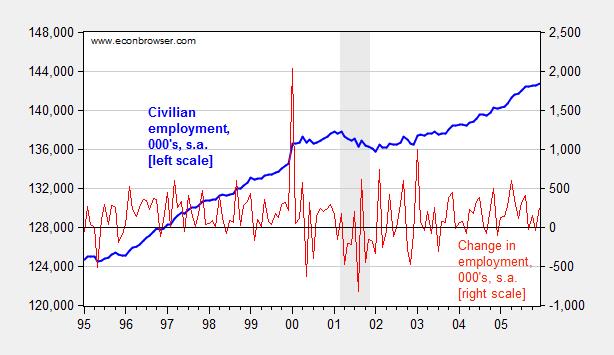

On this period of simply downloadable information, the analyst is tempted to skip to the calculations earlier than studying the footnotes. That is problematic, as a result of, as authorities and worldwide statistical companies acquire information, the mode of the information assortment or the technique of calculation typically change. These modifications are often famous, but when one doesn’t learn the documentation, one could make severe errors. As an example, inspecting civilian employment (FRED sequence CE16OV), one would suppose there was an incredible increase in employment in January 2000.

Determine 1: Civilian employment (blue, left scale) and alter in civilian employment (pink, proper scale), each in 000’s, seasonally adjusted. Supply: FRED sequence CE16OV.

If one inspects different sequence, say nonfarm payroll employment, one sees no corresponding bounce. This means the increase interpretation is unsuitable. Additional proof of a “break” is discovered by inspecting the primary distinction of the sequence (in pink). The spike in January 2000 is a 1.5% change (m/m), whereas the the usual deviation of modifications is 0.3% (calculations in log phrases).

The truth is, the bounce is as a result of introduction of latest inhabitants controls related to the Census. New controls are utilized each decade, so this can be a recurring (and recognized — to those that are cautious) downside. Nonetheless, right here’s an instance of the error concerning the participation determine. Different breaks are much less apparent. This can be a cautionary word to all who obtain information with out consulting the documentation.

Don’t Make Absolute Predictions When Revisions Abound

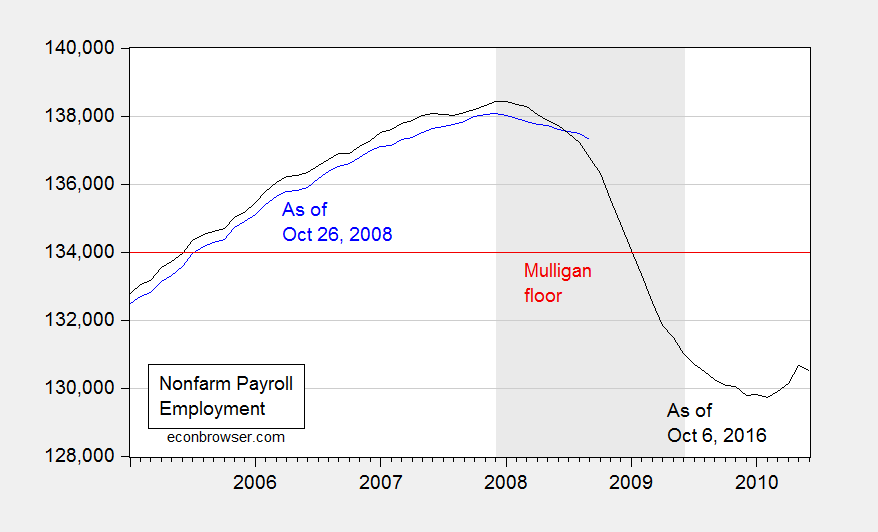

Think about Professor Casey Mulligan on October 26, 2008:

In line with the BLS, nationwide nonfarm employment was 136,783,000 (SA) on the finish of 2006, because the housing value crash was getting underway. Actual GDP was $11.4 trillion (chained 2000 $). Barring a nuclear struggle or different violent nationwide catastrophe, employment is not going to drop beneath 134,000,000 and actual GDP is not going to drop beneath $11 trillion. The numerous economists who predict a extreme recession clearly disagree with me, as a result of 134 million is simply 2.4% beneath September’s employment and solely 2.0% beneath employment throughout the housing crash. Time will inform.

Time has informed. Here’s what really occurred.

Determine 2: Nonfarm payroll employment, September 2008 launch (blue), and September 2016 launch (black), and 134,000,000 employment ground cited by Casey Mulligan (pink). NBER outlined recession dates shaded grey. Supply: BLS through FRED and ALFRED.

Right here is the place realizing about revisions is essential. Not solely was lastly revised employment 537,000 beneath what was estimated as of end-October; employment was falling a lot sooner than estimated on the time. For the three months ending in August 2008, employment was falling 309,000/month, somewhat than 99,700/month.

Fascinated by the information as settled numbers, somewhat than estimates, can result in embarrassingly inaccurate conclusions, to be lengthy immortalized on the web.

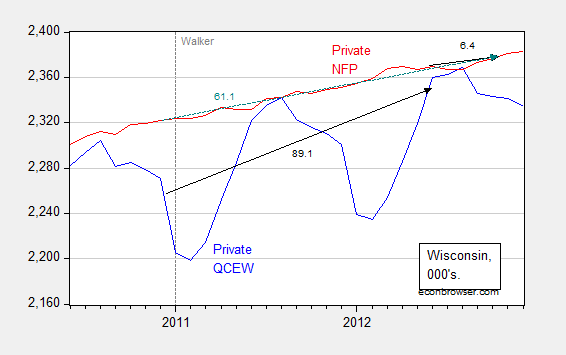

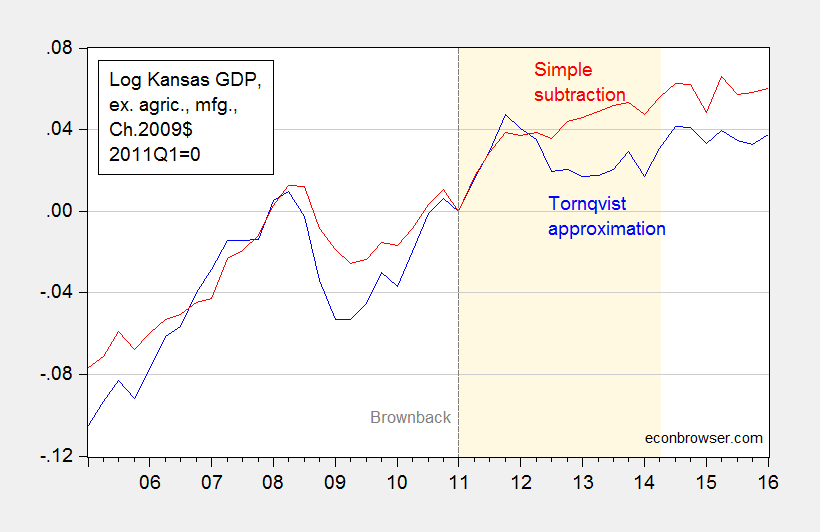

Don’t Do Easy Subtraction of Chain Weighted Measures

At Political Calculations, Ironman has centered on drought and manufacturing (significantly plane) as an evidence for Kansas’s lagging financial fortunes. Particularly, he asserts that actual Kansas GDP stripped of agriculture and manufacturing seems to be significantly better. Sadly, his graph in his publish plots a sequence the place he calculated Kansas GDP ex-agriculture and manufacturing by merely subtracting actual agriculture and actual manufacturing — each measured in Chain weighted {dollars} — from actual GDP measured in Chain weighted {dollars} (the pink line in Determine 3 beneath). That is, fairly plainly, the unsuitable process, as I defined in this publish.

Determine 3: Log Kansas actual GDP ex. agriculture and manufacturing, calculated utilizing Törnqvist approximation (blue), and calculated utilizing easy subtraction (pink), 2011Q1=0. Dashed line at 2011Q1, Brownback takes workplace. Gentle tan shading denotes interval throughout which Ironman identifies as drought. Supply: BEA and creator’s calculations.

Utilizing sturdy manufacturing as an alternative of complete manufacturing doesn’t change the outcomes. In different phrases, Ironman’s conclusion is totally overturned when utilizing the proper calculation. So, beware making conclusions while you don’t perceive the information!

Don’t Defend Factoids as Information

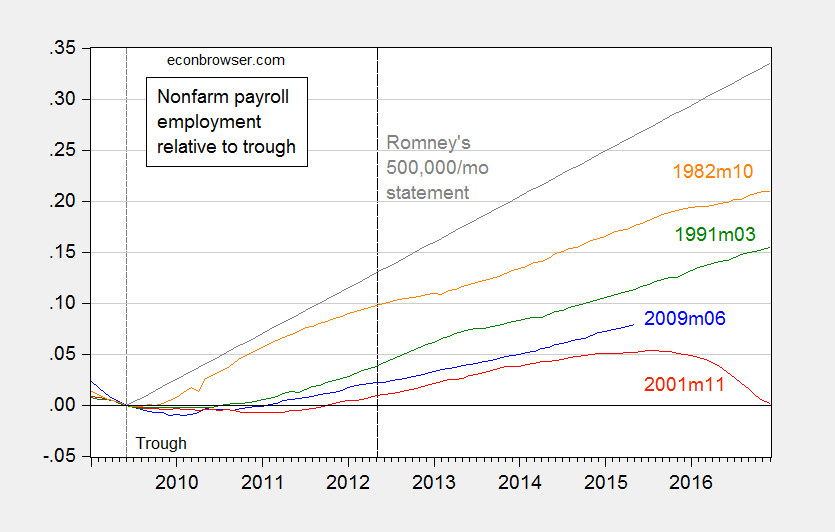

On this period of the web, it’s essential to keep in mind that the obstacles to circulating misinformation are very low. Right here is Governor Romney making a factual assertion, as quoted in Salon (see additionally WSJ):.

“We needs to be seeing numbers within the 500,000 jobs created per thirty days. That is manner, manner, manner off from what ought to occur in a traditional restoration.

That is patently, unsuitable, as mentioned in this publish. However right here is frequent commenter Rick Stryker attempting to alter the phrases of debate:

Counting the variety of occasions that month-to-month employment will increase had been larger than 500K since 1939 is simply an try to decrease the bar for what administration supporters know of their hearts is a failed presidency.

In 1939, the scale of the labor power was 30 million; at present it’s 133 million. A 500K month-to-month enhance on 30 milion [sic] could be really gigantic and under no circumstances what Romney was advocating. To place Romney’s comment in context, we have to modify for the present dimension of the labor market, which we are able to merely do by dividing 500K into 133 million, yielding 0.38%. Going again to 1939, there are 172 instances through which month-to-month employment features had been not less than 0.38% of the present labor market dimension. Admittedly, the final time we noticed sustained will increase of 0.38% of present labor market ranges was throughout the restoration from the 1982 recession. However that simply implies that Romney is setting an formidable however not traditionally unreasonable employment objective. Given the scale of the present employment gap, it is usually obligatory objective if we’re to return to full employment anytime quickly.

…

Be aware how Mr. Stryker tries to re-state Governor Romney’s assertion to make it appear extra cheap, in proportional phrases. As I display in this publish, the five hundred,000 quantity nonetheless stays clearly unsuitable, even after adjusting for labor power dimension. That is proven within the determine I generated on the time:

Determine 3: Log nonfarm payroll employment relative to 2009M06 trough (blue), to 2001M11 trough (pink), to 1991M03 trough (inexperienced), 1982M10 trough (orange). Lengthy dashed line at 2012M05 on the time of Governor Romney’s remarks. Supply: BLS, Might 2015 launch, and creator’s calculations.

Then the declare turns into aspirational, somewhat than factual. Quoting Mr. Stryker once more:

…

Setting formidable however cheap objectives is simply what a future President needs to be doing. Supporters of the present administration perceive that they should decrease expectations nevertheless. It was amusing to learn erstwhile ecstatic now lukewarm Robert Deniro’s remarks to NBC’s David Gregory, which in all probability sums it up properly for administration defenders: “..it’s not simple to be President of america.” And: “I do know he’ll do higher within the subsequent 4 years…”

This course of of adjusting the goalposts is the surest signal of somebody realizing they’ve misplaced the argument, however refusing to confess error. Even Governor Romney subsequently modified his declare to 250,000 new jobs/month as being customary.

So youngsters, don’t be a “Rick Stryker”. Admit while you’ve made a mistake.

For different errors to keep away from, see Rookie Economist Errors

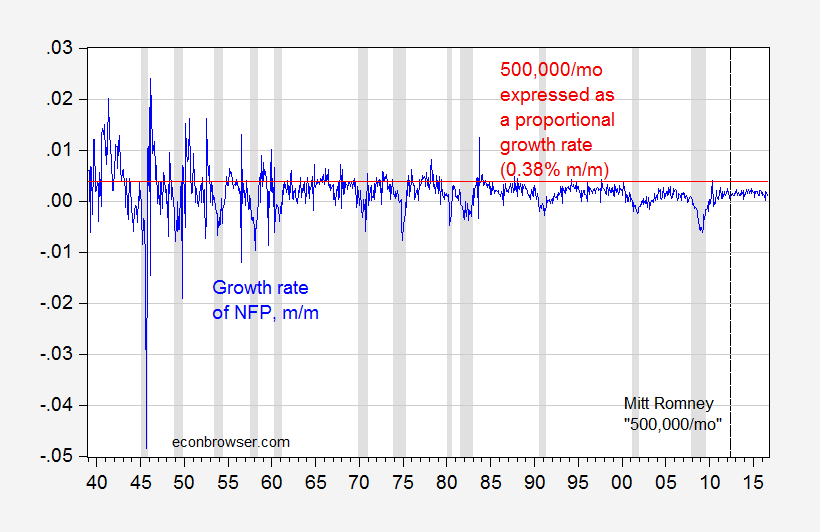

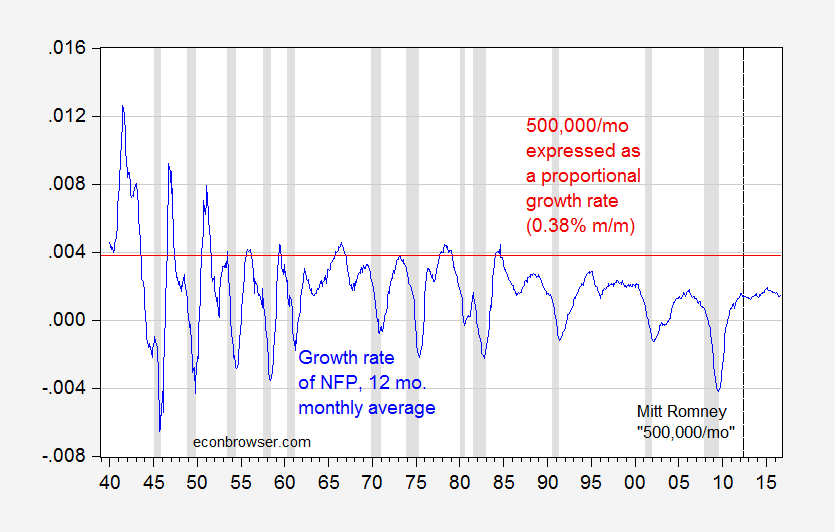

Replace, 10/13 4:45pm Pacific: The pseudonymous Rick Stryker retains on digging. Beneath are two graphs — the primary of month-on-month employment development, and the 0.38% threshold that Stryker mentions as equal to Governor Romney’s 500,000/month employment development, and the second as trailing 12 month-to-month common. The second highlights simply how uncommon it’s for the five hundred,000/mo determine to be realized over something like a steady time-frame in latest many years, even when expressing in proportional phrases as Rick Stryker suggests.

Determine 4: Month-on-month development price of nonfarm payroll employment (blue), and 0.38% threshold (pink line). NBER outlined recession dates shaded grey. Supply: BLS, NBER, and creator’s calculations.

Determine 5: Trailing twelve month month-to-month common development price of nonfarm payroll employment (blue), and 0.38% threshold (pink line). NBER outlined recession dates shaded grey. Supply: BLS, NBER, and creator’s calculations.

Seems to be like one has to go manner again to get the five hundred,000 norm to be cheap…

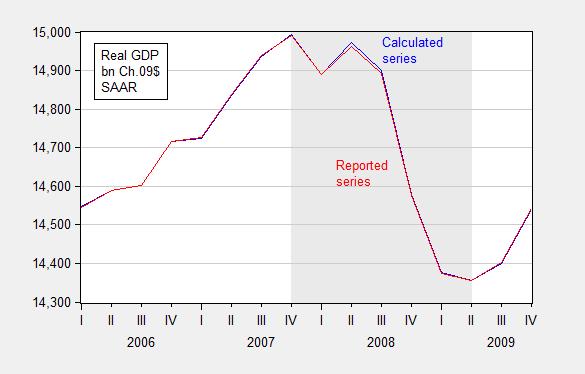

Replace, 10/17 4:15pm Pacific: Within the curiosity of comprehensiveness, let me word an error I made, involving Rounding Errors (first famous in this publish).

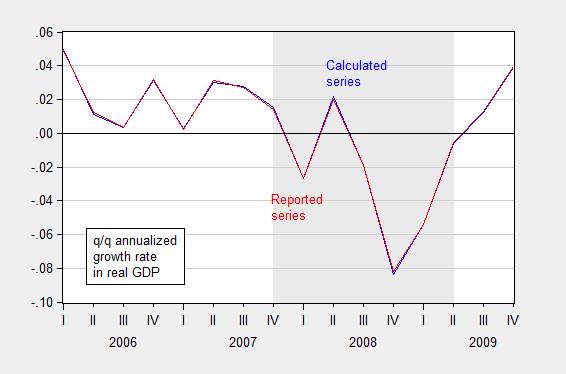

In precept, actual amount = complete worth/value deflator. As an example GDP09 = GDP/PGDP09, the place GDP is measured in $, PGDP09 is the GDP deflator taking up a price of 1 in 2009, and GDP09 is GDP measured on 2009$. In follow, there’s a slight rounding error, which usually doesn’t make a distinction, however can if (1) development charges are very excessive (or very detrimental), and (2) one is annualizing quarterly development charges.

I used the manually deflated sequence for the 2008Q4 q/q calculation, when on this case it will have been higher to make use of the true sequence reported by BEA to do the calculation.

Figures 6 and seven present the rounding errors.

Determine 6: GDP in bn. Ch.2009$ SAAR, calculated by deflating nominal GDP with the GDP deflator (blue) and as reported by BEA (pink), FRED sequence GDPC1. Supply: BEA 2014Q2 2nd launch and creator’s calculations.

Determine 7: Quarter-on-quarter annualized development price in GDP in bn. Ch.2009$ SAAR, calculated by deflating nominal GDP with the GDP deflator (blue) and as reported by BEA (pink), FRED sequence GDPC1. Supply: BEA 2014Q2 2nd launch and creator’s calculations.

But extra errors:

Don’t be informal about estimated traits.

Don’t make coverage evaluation based mostly on not-statistically-significant parameters.

Don’t attribute all belongings you don’t imagine in to “conspiracy”, earlier than checking the information your self. (By the best way, simply because there’s no conspiracy doesn’t imply the information are unbiased or noisy).