Reply: Sure, and (to a lesser extent) Sure.

Contemplate the present state of affairs.

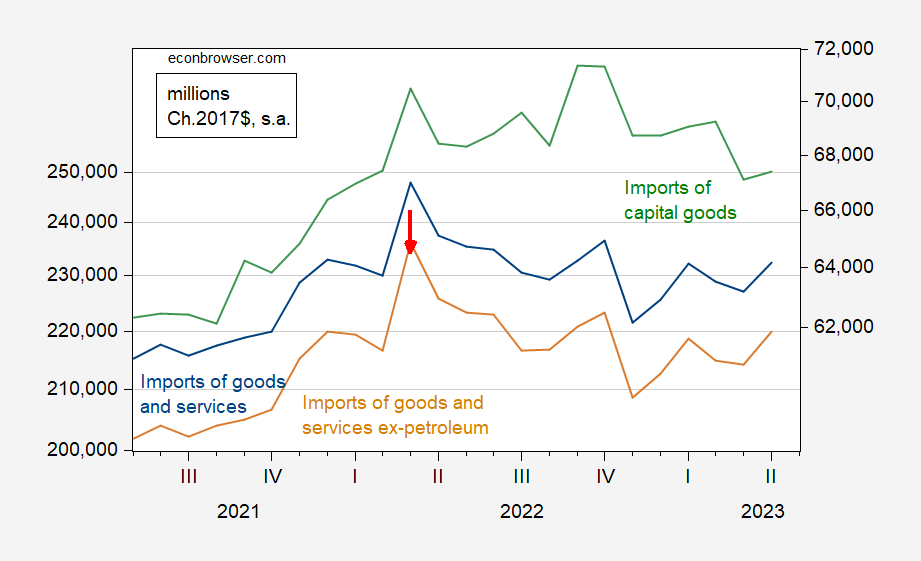

Determine 1: Imports of products and companies (blue), imports of products and companies ex-petroleum (tan), imports of capital items (inexperienced, proper scale), all in miilions of Ch.2017$. Supply: BEA.

Actual imports of products and companies excluding petroleum peaked in March of 2022. They, and whole imports, stay beneath these ranges. Capital items imports — which ought to mirror extra ahead trying habits — peaked in September of 2022.

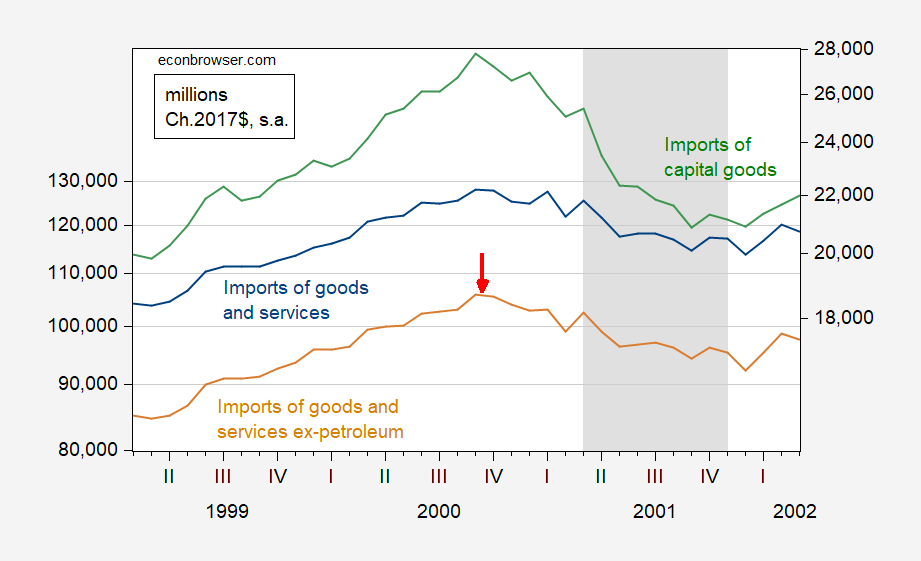

Actual imports did peak earlier than the recession of 2001.

Determine 2: Imports of products and companies (blue), imports of products and companies ex-petroleum (tan), imports of capital items (inexperienced, proper scale), all in miilions of Ch.2017$. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER.

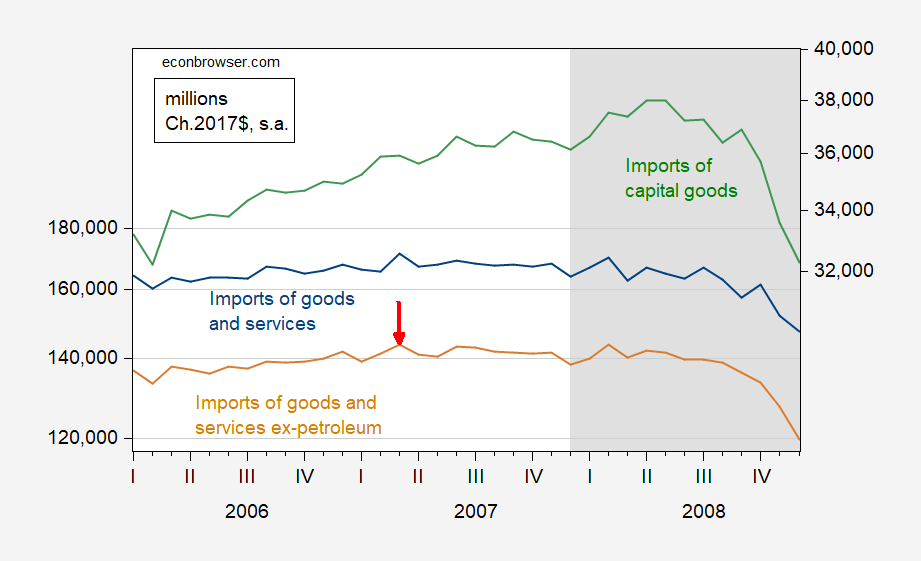

Alternatively, whereas imports ex-petroleum peaked in March 2007 (really technically peaked barely greater in February 2008), capital items peaked in April of 2008, months into the recession as outlined by NBER.

Determine 3: Imports of products and companies (blue), imports of products and companies ex-petroleum (tan), imports of capital items (inexperienced, proper scale), all in miilions of Ch.2017$. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER.

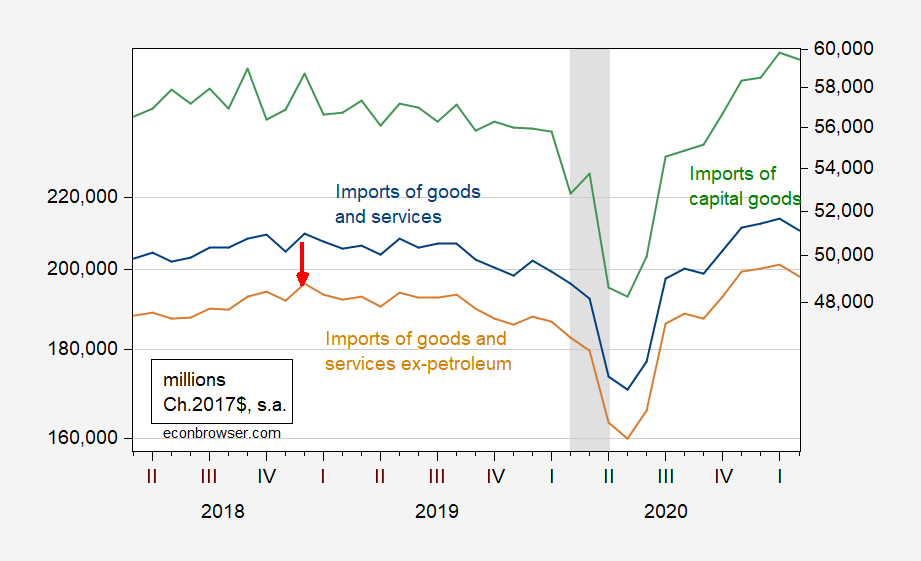

Lastly, within the final recession, imports ex-petroleum peaked in December of 2018. And capital items imports really peaked in September of that 12 months.

Determine 4: Imports of products and companies (blue), imports of products and companies ex-petroleum (tan), imports of capital items (inexperienced, proper scale), all in miilions of Ch.2017$. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, NBER.

Therefore, mixture actual imports are usually a comparatively dependable precursor of recessions (subcategories like capital items aren’t essentially so), no less than for the final three recessions. What about false positives — i.e., circumstances the place imports fell however no recession occurred. One needs to contemplate circumstances the place an prolonged interval of flat or declining imports occurred, like half a 12 months. On fast inspection, it seems like there’s just one such case — March 2015, when it took a subsequent 2.5 years to regain that degree. No recession as outlined by NBER occurred then, however as many have famous, there was a producing droop beginning in 2014M12, induced by greenback appreciation.

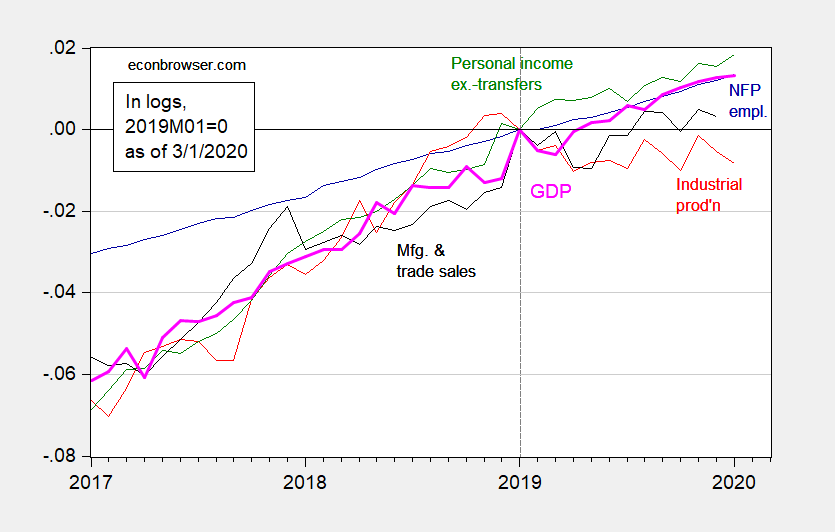

This set of discovering means that, had no pandemic struck, the US would possibly nicely have entered a recession nonetheless. Beneath is an image of key NBER sequence, utilizing real-time information (i.e., information as they have been reported as of March 1, 2023) (from this submit).

Determine 5: Nonfarm payroll employment (blue), industrial manufacturing (pink), private revenue excluding transfers in Ch.2012$ (inexperienced), manufacturing and commerce gross sales in Ch.2012$ (black), and month-to-month GDP in Ch.2012$ (pink), all log normalized to 2019M01=0. Supply: BLS, Federal Reserve, BEA, by way of FRED, Macroeconomic Advisers (2/28 launch), and writer’s calculations.

Discover industrial manufacturing and manufacturing and commerce business gross sales have been trending sideways. The assumption {that a} recession was imminent was in step with my views specified by a January 2019 submit, noting the close to inversion of the yield curve.