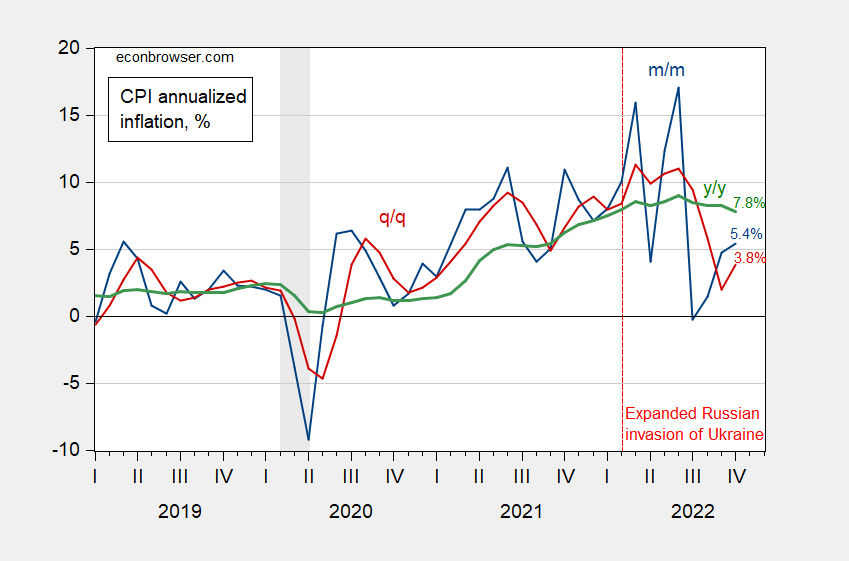

M/M CPI inflation 0.4% vs. Bloomberg consensus 0.6%, whereas core was 0.3% vs. 0.5%. All measures (m/m, q/q, y/y, headline/core) beneath current peaks.

Determine 1: Headline CPI inflation, m/m (blue), q/q (crimson) and y/y (inexperienced), annualized, %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, NBER and creator’s calculations.

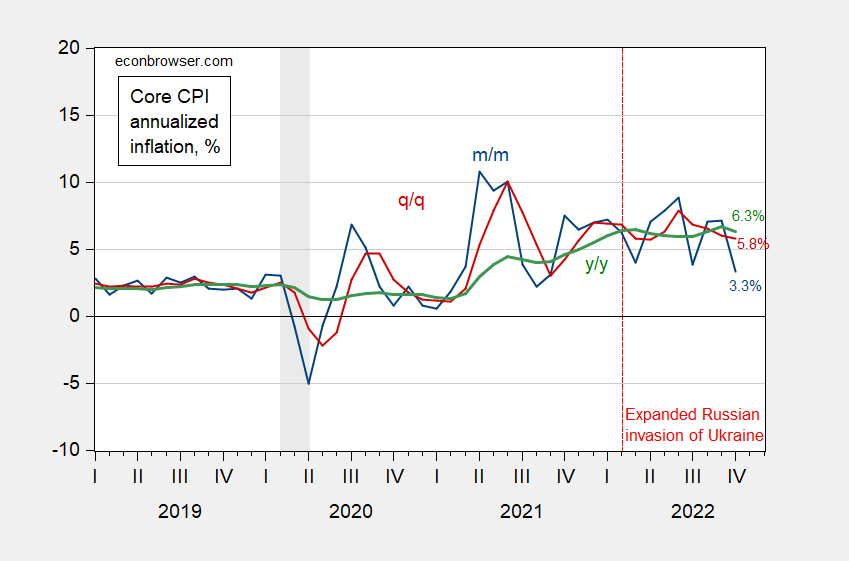

Right here’s the evolution of the core CPI, utilizing the identical scale on the left axis as for headline.

Determine 2: Core CPI inflation, m/m (blue), q/q (crimson) and y/y (inexperienced), annualized, %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, NBER and creator’s calculations.

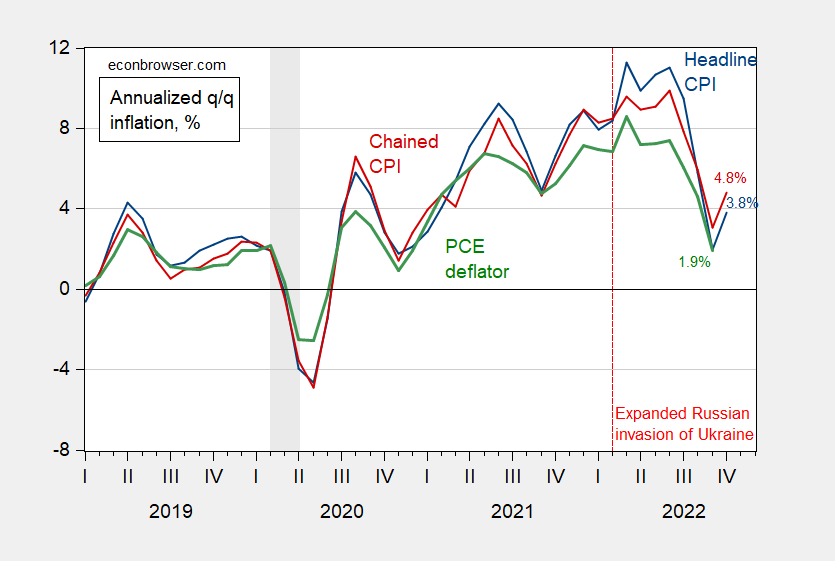

Lastly, notice the official CPI is a Laspeyres base yr weights (with the weights altering extra typically lately), so tends to overstate — for any given bundle of products and companies — the speed of inflation. The chained CPI mitigates that by having the bundle change every year. The PCE deflator is a chained index which, other than the included items and companies, also needs to incorporate spending adjustments extra quickly than the Laspeyres sort indexes.

Determine 3: Headline CPI (blue), chained CPI (crimson) and private consumption expenditure deflator (inexperienced), q/q annualized, %. Chained CPI adjusted utilizing Census X-13, ARIMA X-11 seasonal adjustment. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, BEA, NBER and creator’s calculations.

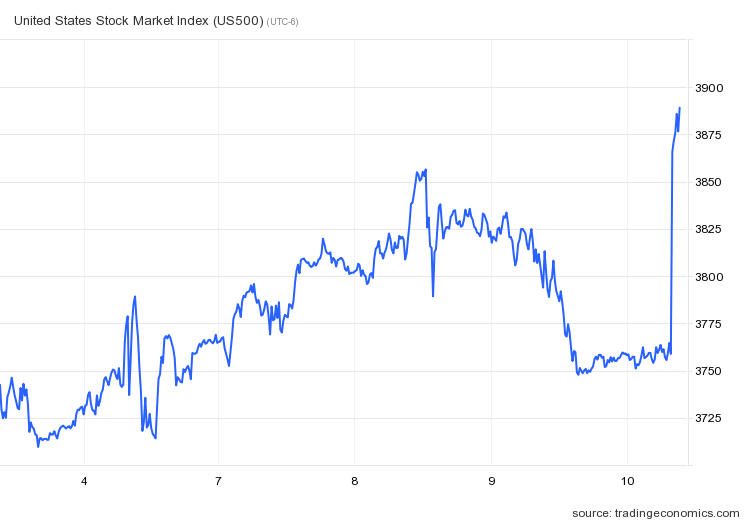

Addendum:

Market response was massive and fast. Ten yr bond yield, greenback index each down. Inventory market up.