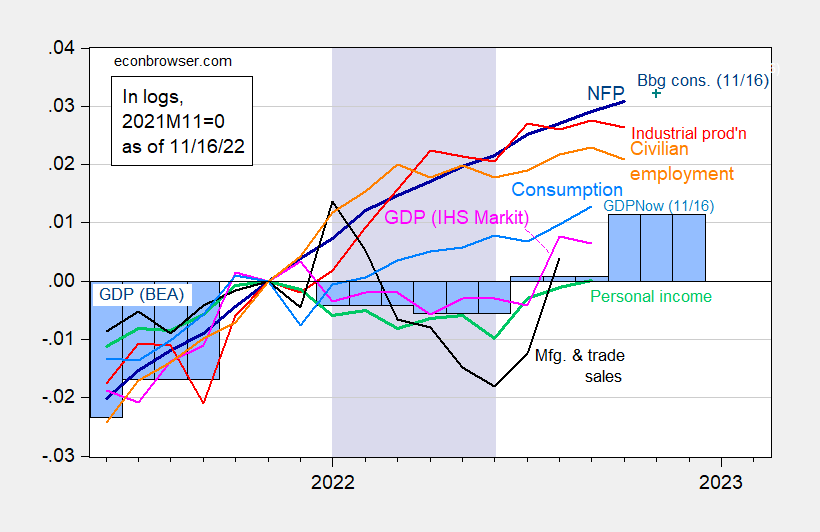

Industrial manufacturing declined 0.1% m/m, vs. Bloomberg consensus +0.2. NFP employment rose in October strongly. Different key indicators adopted by NBER Enterprise Cycle Relationship Committee.

Determine 1: Nonfarm payroll employment, NFP (darkish blue), Bloomberg consensus as of 11/16 (blue +), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding transfers in Ch.2012$ (inexperienced), manufacturing and commerce gross sales in Ch.2012$ (black), consumption in Ch.2012$ (gentle blue), and month-to-month GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 GDP is from GDPNow for 11/16. Lilac shading denotes a hypothetical recession in 2022H1. Supply: BLS, Federal Reserve, BEA, by way of FRED, IHS Markit (nee Macroeconomic Advisers) (11/1/2022 launch), GDPNow (11/16) and creator’s calculations.

Whereas industrial manufacturing declined, and manufacturing manufacturing rose solely 0.1% vs. 0.2% m/m consensus, retail gross sales far exceeded expectations.

GDPNow as of right now is for 4.382% q/q SAAR in This fall. Given the doubtless revisions in GDP and the evolution of GDO, it appears unlikely (nonetheless) to me {that a} recession occurred in 2022H1. A recession in 2023 nonetheless, appears doubtless given yield curve inversions and different predictors.