Yesterday’s Bloomberg article “Fed Workers Sees a 50-50 Likelihood of Recession” spurred me to look at the implications of the newest readings on time period spreads. Determine 1 depicts the recession possibilities estimated utilizing a easy probit mannequin based mostly on the 10yr-3mo and 10yr-2yr spreads, by means of November twenty third.

Determine 1: Forecasted likelihood of recession from 10yr-3mo time period unfold (blue), from 10yr-2yr time period unfold (tan), 10yr-3mo time period unfold augmented by FCI, overseas time period unfold (inexperienced). All fashions estimated over 1986M01-2022M11. NBER outlined peak-to-trough recession dates shaded grey. Crimson dashed line at 50% likelihood. Supply: creator’s calculations, NBER.

Whereas neither the 10yr-3mo and 10yr-2yr fashions breach the 50% threshold, they’re sufficiently near advantage a 50-50 studying.

In work by Ahmed and Chinn (2022), it’s proven that the overseas time period spreads and monetary situations index have extra predictive energy for US recessions (see Desk A.1). I increase the 10yr-3mo unfold with the common of German-Euro Space/UK/Japan 10yr-3mo spreads, and the nationwide monetary situations index, to acquire the estimated possibilities of recession proven within the inexperienced line in Determine 1. The studying for November 2023 is 56%.

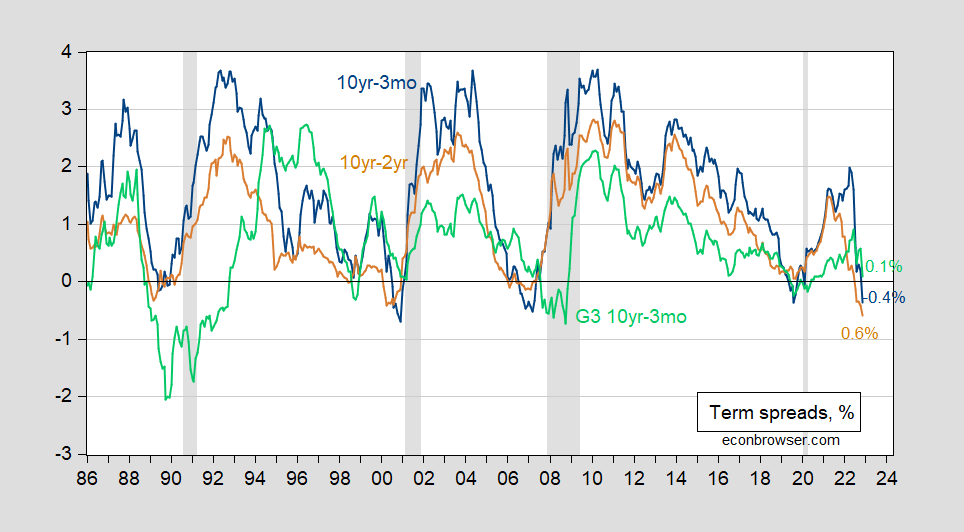

All these estimates are based mostly upon the next time period spreads:

Determine 2: US Treasury 10yr-3mo time period unfold (blue), 10yr-2yr (tan), and G3 Germany/UK/Japan 10yr-3mo (inexperienced), all in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, OECD Predominant Financial Indicators, NBER, and creator’s calculations.