Right here’s the expansion path in keeping with the FT-IGM survey that closed March sixteenth, a couple of week after the unfolding of occasions surrounding SVB.

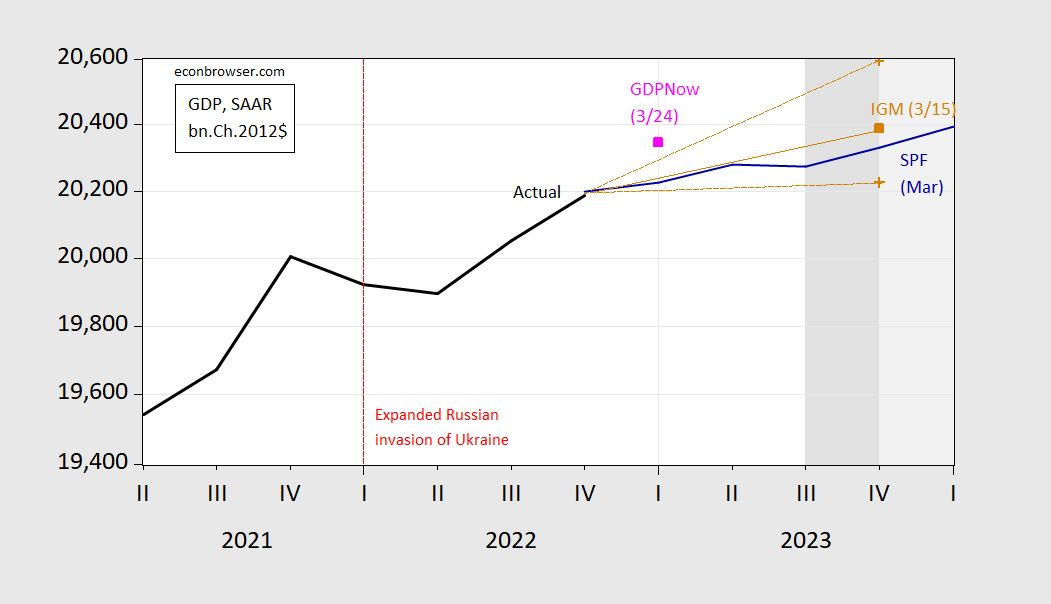

Determine 1: GDP (black), SPF median (blue), FT-IGM Median (tan sq.), and tenth and ninetieth percentile (tan +), GDPNow (pink sq.), all in bn Ch.2012$ SAAR. Modal response for recession dates shaded darkish grey. Supply: BEA 2nd launch, Atlanta Fed (3/24), Philadelphia Fed, FT-IGM March survey, and creator’s calculations.

The median from the FT-IGM survey was for 1% progress this autumn/this autumn in 2023, with tenth percentile at 0.2%, and ninetieth at 2% (my level estimate was 0.7%). The median progress price locations the GDP stage barely greater than that implied by the February Survey of Skilled Forecasters median (survey accomplished close to finish of January).

Taking the Atlanta Fed’s GDPNow nowcast as of March 24 implies basically zero internet progress in Q2-This autumn. Modal response for starting of a recession (as decided by NBER) is 2023Q3 or 2023Q4.

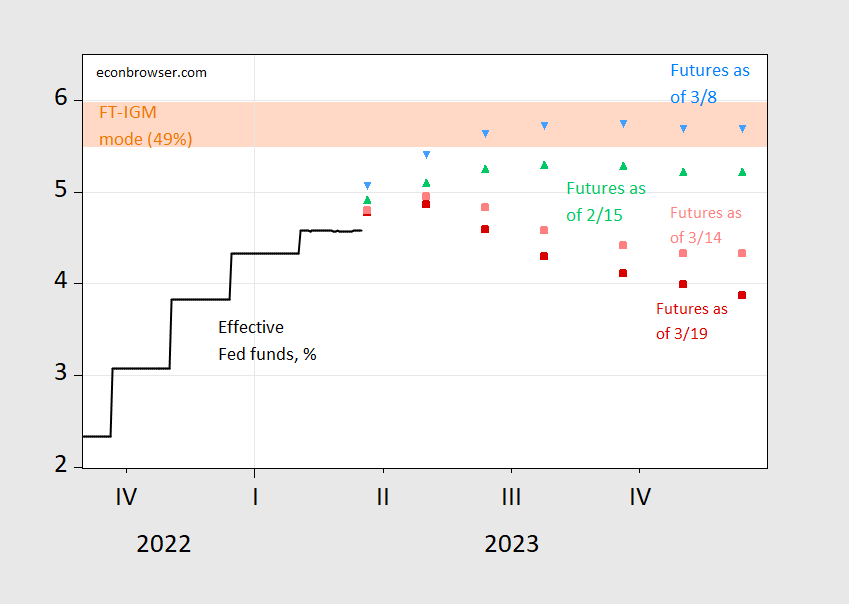

One other attention-grabbing end result pertains to the height Fed funds price. The modal response (49% of respondents) was between 5.5%-6%. This was greater than the height implied by CME futures as of three/15, and much more in order of three/19.

Determine 2: Efficient Fed funds (black), implied Fed funds as of March 22 6PM CT (purple sq.), March 19, 4:30 CT (pink sq.), March 8 (sky blue inverted triangle), and February 15 (inexperienced triangle). Gentle orange shading denotes modal response for peak charges from FT-IGM survey. Supply: Fed by way of FRED, CME Fedwatch, FT-IGM March survey, and creator’s calculations.