For these on the left … too many people have been occupied with defending packages the best way they had been written in 1938.” —Barack Obama, 2006 “I’m glad we gained the race in New York, however I hope the Democrats don’t use it as an excuse to do nothing on Medicare.”

There I made the purpose that the street to the debt ceiling deal was solely avoidable; thus it was a street that nationwide Democrats needed to take. I additionally speculated on why this was.

However the scholar debt a part of the dialogue deserves its personal dialogue.

Take into account the chart on the high, which reveals the speed of scholar debt development as a proportion of non-mortgage shopper debt. The speed is astounding.

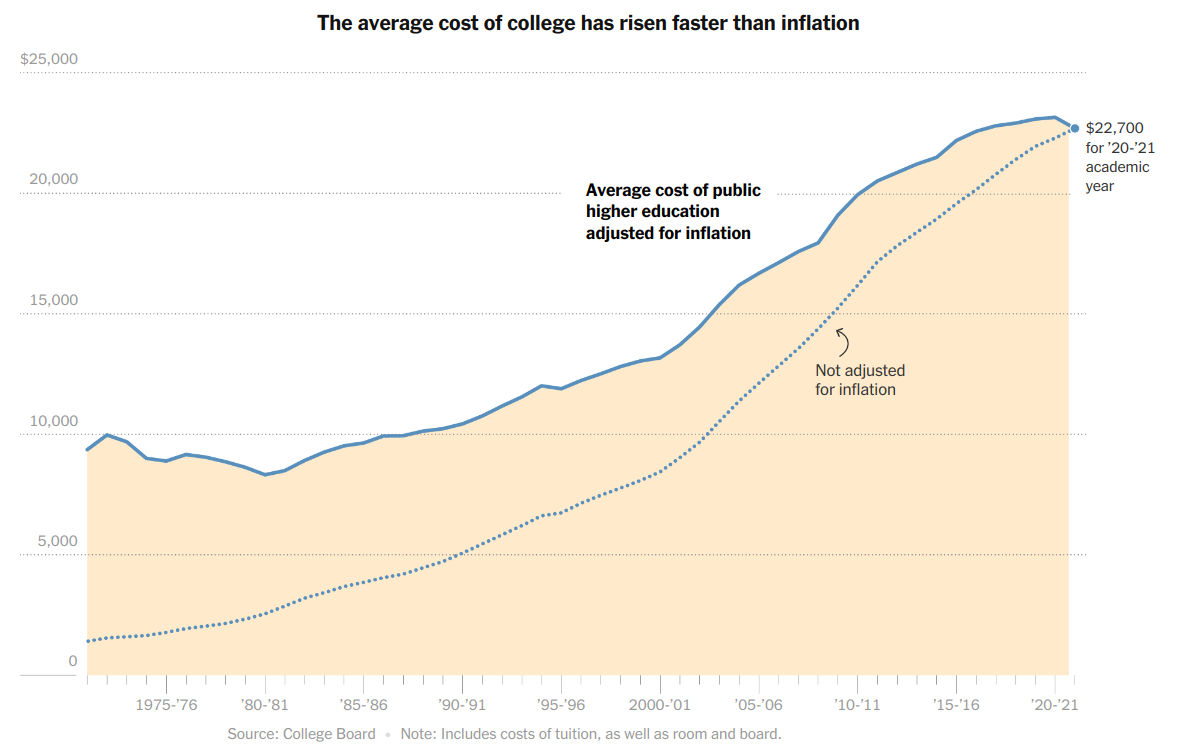

Now take into account this, the speed of enhance of the value of public increased schooling from the New York Occasions:

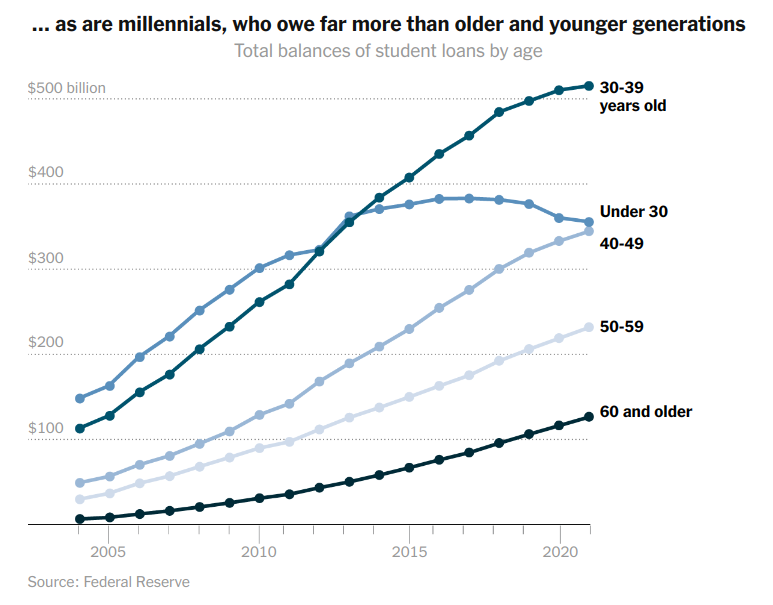

The share of this debt burden shouldn’t be evenly break up. Because the Occasions factors out, millennials carry an unequal share. (Be aware that these below 30 look like giving up on faculty.)

How massive is the scholar debt burden? In line with Forbes (paywalled article) as of Could, 2023 the scholar debt image seems to be like this (emphasis mine):

- $1.75 trillion in complete scholar mortgage debt (together with federal and personal loans)

- $28,950 owed per borrower on common

- About 92% of all scholar debt are federal scholar loans; the remaining quantity is non-public scholar loans

- 55% of scholars from public four-year establishments had scholar loans

- 57% of scholars from non-public nonprofit four-year establishments took on schooling debt

Almost two trillion {dollars} is the scholar debt burden at the moment, up from a tenth of that within the mid-2000s.

Neoliberal Authorities at Work

Why is the nationwide scholar debt burden so excessive? In reply, I give you this, a remark posted by “lincoln” on the glorious economics web site Bare Capitalism(emphasis within the authentic):

If we ever wish to correctly repair the U.S. scholar debt disaster, then we have to perceive precisely the way it was created.

College students borrow cash to pay universities, that are the principle beneficiary of the $1.7 trillion in excellent scholar debt. How a lot college students borrow has ballooned exponentially during the last 15 years. This was throughout a interval of report low borrowing prices (see Fed ZIRP – Zero Curiosity Price Coverage), and a drop in faculty enrollment.

Our federal authorities loans trillions of {dollars} to a universities college students, so these college students pays no matter schooling associated prices the college decides is affordable. And this value is non-negotiable. The trillions in federal scholar loans that universities get is along with their exemption from all federal and state revenue taxes, their exemption from paying property taxes on college land, and their proper to difficulty tax exempt bonds to fund building, renovation, and operational prices. This doesn’t embrace the $50 billion per 12 months the U.S. authorities pays to universities in federal contracts and analysis grants. These establishments are eligible for nearly each authorities subsidy and tax loophole possible.

If nothing is finished to reign in and scale back how a lot universities cost their college students, then future scholar debt is simply going to maintain ballooning. Forgiving scholar debt gained’t repair this downside, it may well solely delay a a lot wanted reckoning. …

The ballooning of this debt that began a scholar mortgage disaster didn’t slowly develop over the course of a long time. Most of it occurred after the 2008 Nice Monetary Disaster. Mainstream media has been extraordinarily hesitant to level this out, in addition to that universities are essentially the most liable for creating and perpetuating our scholar debt disaster.

His backside line and mine: When authorities sells schooling as the reply to government-caused wealth inequality, and makes trillions in scholar loans obtainable to the trade that provides it, authorities helps that trade fleece its clients.

The coed mortgage program is a switch of wealth to wealthy establishments from the working class. How stunning is that in these neoliberal occasions?