In distinction to the July WSJ survey, the just-released Survey of Skilled Forecasters imply forecast exhibits no damaging GDP progress.

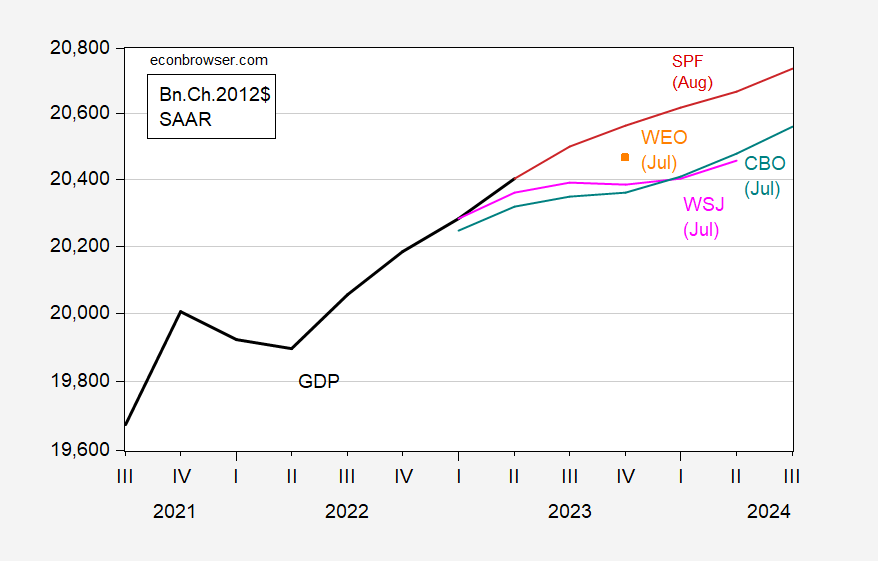

Determine 1: GDP (daring black), August SPF (pink), July WSJ survey (pink), CBO projection (teal), World Financial Outlook (orange sq.), all in bn. Ch.2012$ SAAR. Supply: BEA, Philadelphia Fed, WSJ survey, July CBO Financial Outlook Replace, IMF World Financial Outlook July Replace, and creator’s calculations.

The SPF forecast is considerably above the WSJ, partly as a result of it incorporates the precise Q2 advance estimate. Respondents to the July WSJ survey, in addition to the CBO and IMF employees, didn’t have the Q2 advance estimate at time of forecasting.

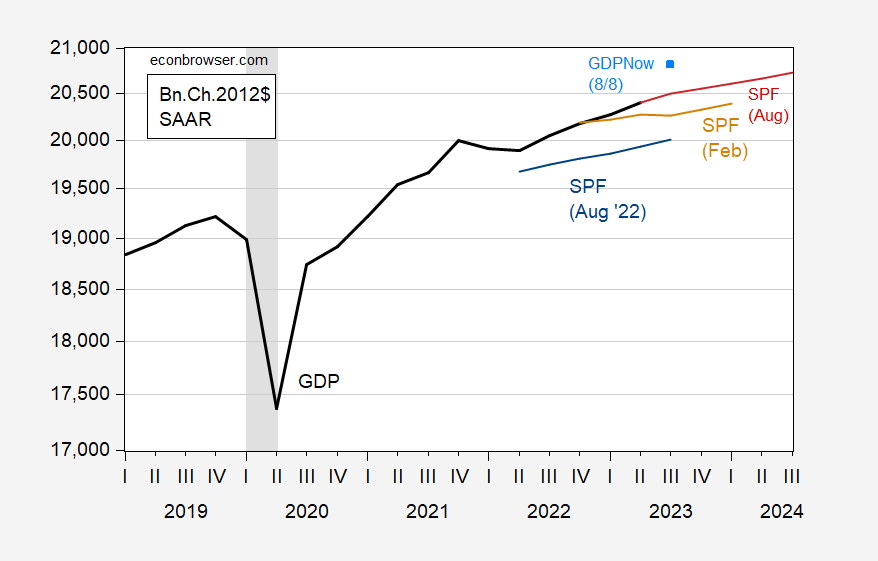

The August SPF signifies each quicker progress, and better degree of output, than the February SPF, which was once more above the August SPF (albeit with slower progress).

Determine 2: GDP (daring black), August SPF (pink), February SPF (tan), August SPF (blue), GDPNow of 8/8 (sky blue sq.), all in bn. Ch.2012$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, Philadelphia Fed, Atlanta Fed, NBER, and creator’s calculations.

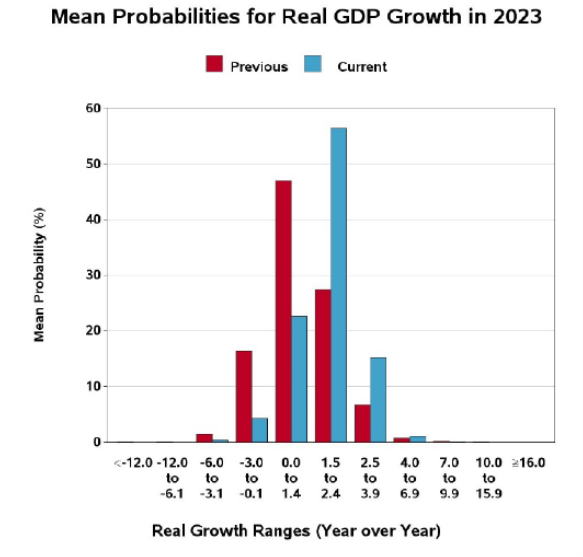

The y/y progress price distribution has noticeably shifted up for the reason that Might survey.

Supply: SPF (August, 2023).

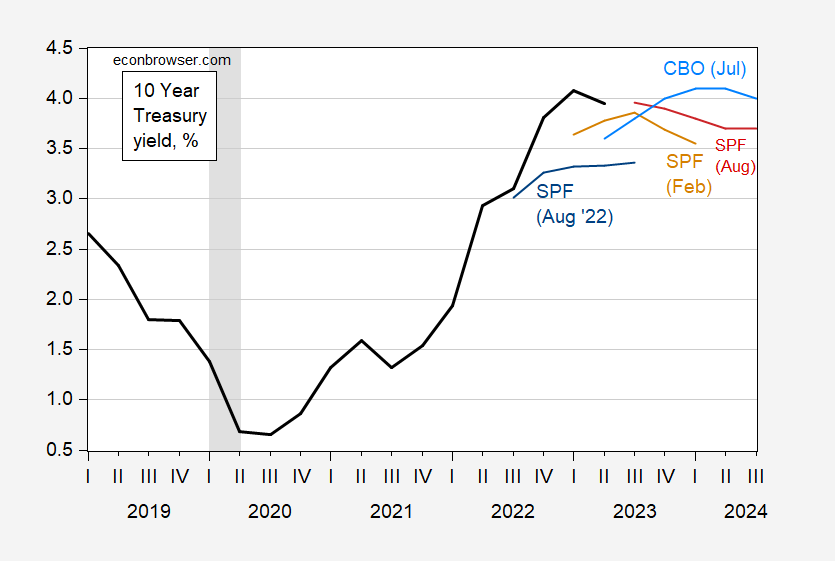

Be aware that whilst progress has confirmed resilient, the forecasted ten 12 months yield has moved up (though nonetheless beneath CBO projection in 2024).

Determine 3: Ten 12 months Treasury yield (daring black), August SPF (pink), February SPF (tan), August SPF (blue), CBO (sky blue), all in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, Philadelphia Fed, CBO Financial Outlook July Replace, NBER, and creator’s calculations.