What’s your reply to the query: How Near Full Capital Mobility Are We?

It’s received to rely upon what nations are concerned, what time horizon, and many others. In a current paper entitled “Measuring Monetary Integration:

Extra Information, Extra Nations, Extra Expectations”, Hiro Ito and I sort out this query of mobility and substitutability (terminology as a result of Frankel), relying upon a key decomposition:

The objects within the [square bracket] and <angle bracket> are related to the query of why rates of interest, adjusting for anticipated trade charges, differ. Frankel (1983) outlined zero coated curiosity differentials as full capital mobility, and 0 trade threat premium as full capital substitutability, and on this dialogue I retain this terminology, and related decomposition.

Coated curiosity differentials was attributed to the presence of capital controls, or the specter of imposition thereof. Extra not too long ago, they’ll come up (in the true world) due to capital necessities and different regulatory-induced frictions, related liquidity points, in addition to default threat. Trade threat premium — the deviation between ahead low cost and anticipated depreciation — is related to the chance of holding a forex, in earlier instances modeled as return covariance with wealth, or extra not too long ago (1990’s) with return covariance with consumption progress.

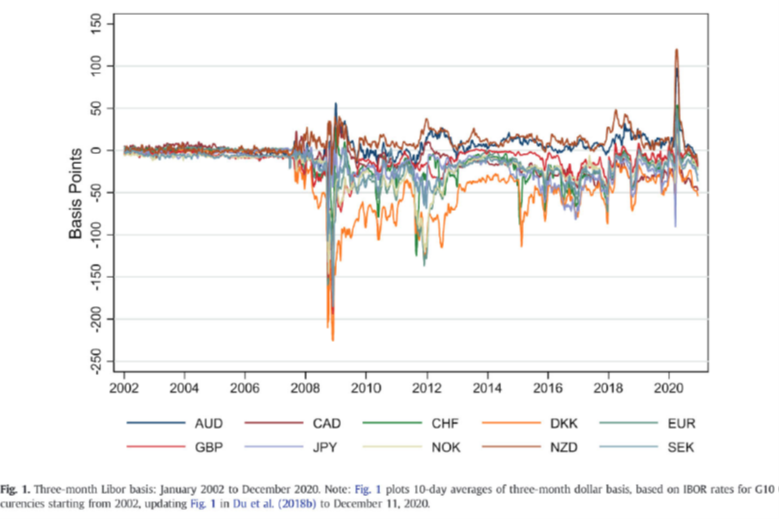

By the criterion of coated curiosity parity holding, mobility appears to have decreased within the wake of the International Monetary Disaster, as this graph from Cerutti et al. signifies.

Determine 1: Coated curiosity differentials, bps. Supply: Cerutti et al. (2021).

Whereas monetary capital is now much less free to maneuver, it’s vital to grasp that to a sure extent, this improvement is intentional; that’s the deviations lately are partly pushed by capital necessities which might be geared toward decreasing the chance of crises in brief time period credit score markets (see dialogue in Wu and Schreger, 2021). For six rising markets, the place various factors come into play, see the paper by Geyickzi and Ozyildirim (2021, JIFMIM 2023).

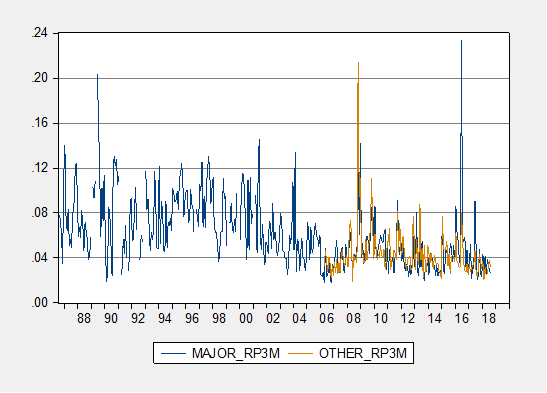

For the second merchandise, regarding trade threat, we forego the rational expectations assumption and use survey knowledge to guage the dimensions of trade threat premia at quick horizons (3 months), and discover that over the previous three a long time, they’ve typically decreased, for main forex pairs. Alternatively, for rising market and growing nation currencies (in opposition to the USD), there’s been little change on common over the previous 20 years.

Determine 2: Common absolute uncovered curiosity differential for superior financial system currencies (blue), for rising market currencies (tan), annualized. Calculated utilizing survey knowledge. Supply: Chinn and Ito (2023).

These are measures of deviations from CIP and UIP. They don’t instantly inform the query of “what’s the slope of the BP=0 schedule” within the IS-LM-BP=0 mannequin. However they do counsel that the BP=0 line is unlikely to be completely flat, even for superior economies the place capital controls are absent.

Lecture notes on IS-LM-BP=0 (aka Mundell-Fleming) right here: