Long run actual charges predicted, and r*.

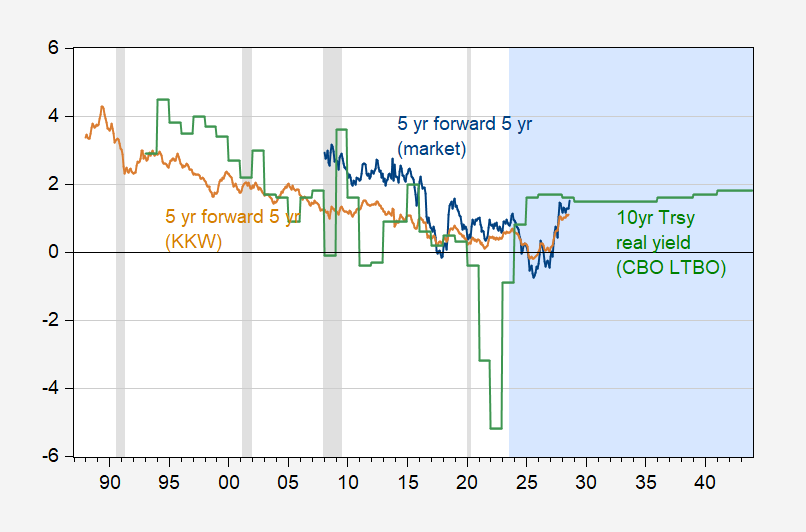

From the market, and from the CBO. BOth are predicting actual charges will rise (though the market indicators appear to have been method off previously few years).

Determine 1: 10 12 months actual Treasury yield from CBO Lengthy Time period Price range Outlook (inexperienced), and 5 12 months 5 12 months ahead actual fee from market, utilizing Survey of Skilled Forecasters 10 12 months inflation median forecast (blue), adjusted from KKW (tan). August 2023 studying for market forecast makes use of information by August 14. Gentle blue shading denotes projection interval. NBER outlined peak-to-trough recession dates shaded gentle grey. Supply: CBO, Treasury through FRED, Philadelphia Fed, KKW, NBER, and creator’s calculations.

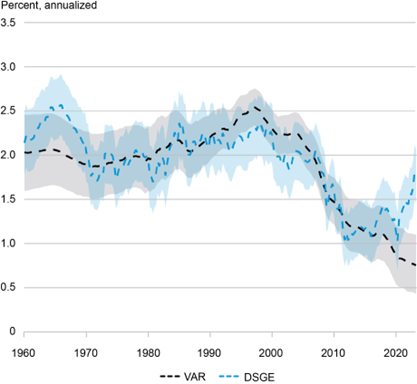

What about r*, the speed that units output at potential output? And listed below are two estimates of r*, from Baker et al. on the NY Fed.

Determine 2:r* estimates from VAR and from DSGE, as described in Baker et al. (2023).

Clearly, as mentioned within the article, there may be some disagreement. The DSGE method signifies a transfer again towards pre-2000 ranges, whereas the VAR signifies that the drop may very well be persistent.