As we speak, we’re happy to current a visitor contribution written by Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti of the Financial institution of Italy. The views offered on this notice characterize these of the authors and don’t essentially replicate these of the Financial institution of Italy.

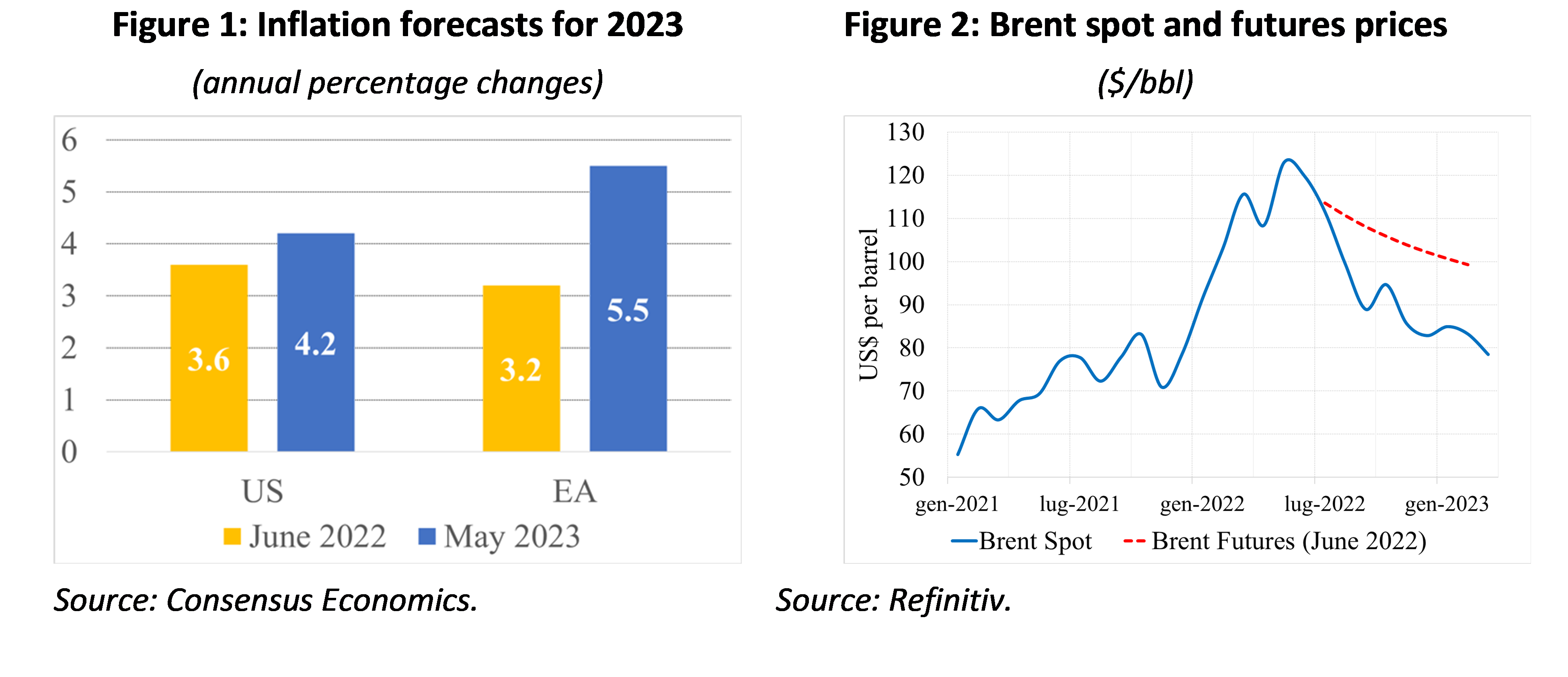

Inflation charges in each the USA and the euro space (EA) have decreased since across the center of 2022. Nevertheless, their fall has not occurred as quickly as initially anticipated. Regardless of the numerous lower in vitality costs, which dropped extra drastically than what was projected by futures costs one yr in the past, skilled forecasters have constantly adjusted their predictions for inflation upwards. This pattern has been significantly noticeable within the euro space (EA), as depicted in Figures 1 and a couple of. Unexpected will increase in core inflation, particularly in non-energy industrial items and companies, have been the first catalyst behind these sudden inflation hikes.[1]

This bears the query whether or not surprisingly excessive core inflation in these economies is the results of the delayed pass-through of previous vitality costs and what will be anticipated going ahead, given the pronounced fall in vitality costs since mid-2022. The evaluation summarized on this column concludes that, in the case of the US, vitality costs account for a negligible fraction of core inflation hikes up to now two years. This isn’t the case for the euro space, the place the pass-through was sizeable and nonetheless ongoing.

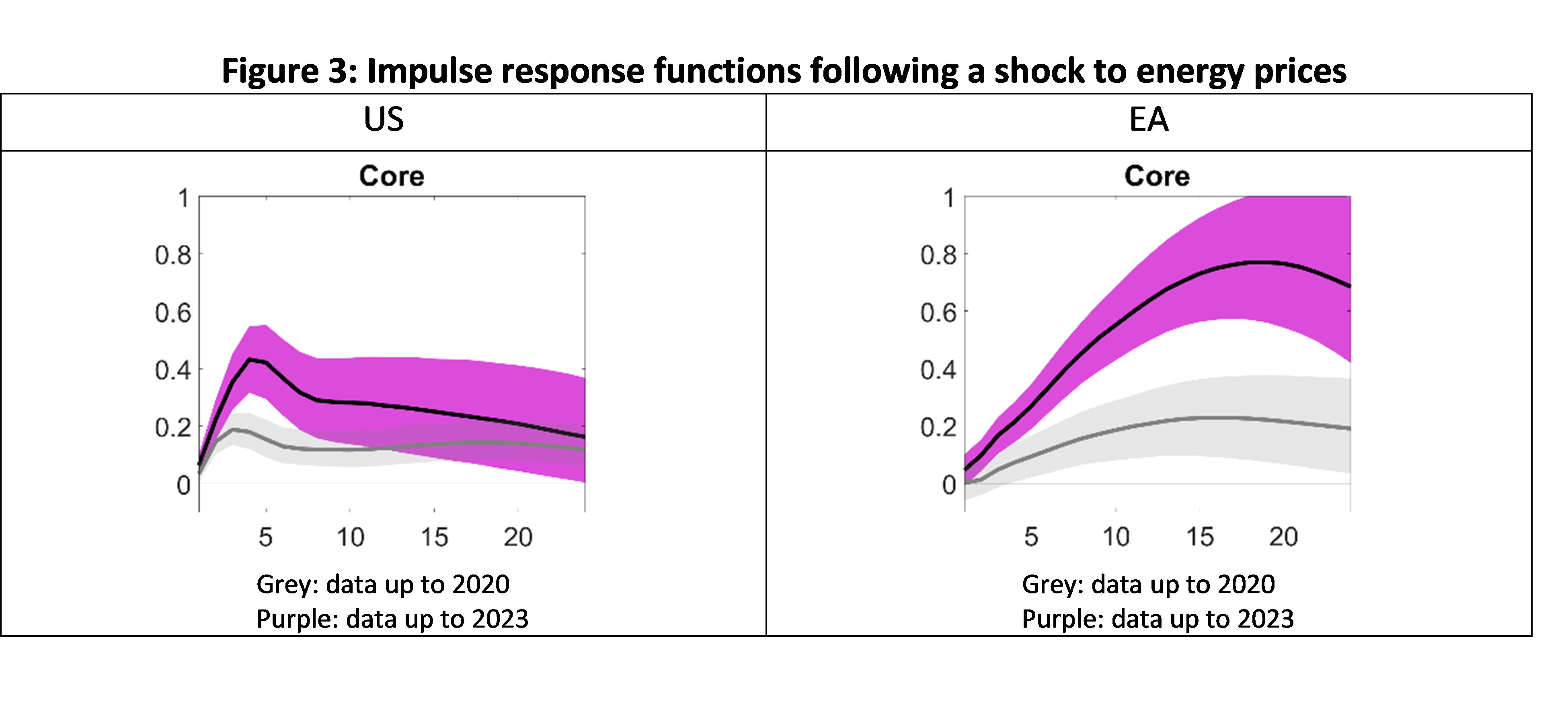

The pass-through of vitality costs to core inflation will be gauged on the premise of the response of core costs to an sudden change in vitality costs within the context of Vector Autoregression fashions. We estimate such a mannequin with information as much as 2020 first (due to this fact excluding the 2021-2022 vitality worth shock), to then prolong the pattern to the final accessible 2023 information level. The baseline specification contains shopper vitality inflation, meals inflation, core inflation[2], the unemployment charge, and negotiated wages progress.[3]

Utilizing information as much as 2020, a pattern that pre-dates the newest vitality worth shock, a ten% enhance in shopper vitality costs results in a comparatively muted rise in core inflation for each the USA and the euro space (EA), by roughly 0.1 to 0.2%, as illustrated in Determine 3 inside the grey-shaded areas. Nevertheless, when the evaluation is prolonged to incorporate the information in 2023, which includes the vitality worth shock of 2021-2022, the response of core inflation to modifications in vitality costs rises considerably within the EA (as indicated by the purple-shaded areas in Determine 3). This means that the surge in vitality costs precipitated a shift within the relationship between core costs and vitality enter prices. Certainly, following a ten% vitality worth shock, the utmost influence on core inflation ensuing from an vitality worth shock is estimated at 0.8% for the EA (a fourfold enhance) and at 0.4% for the US (solely a twofold enhance).

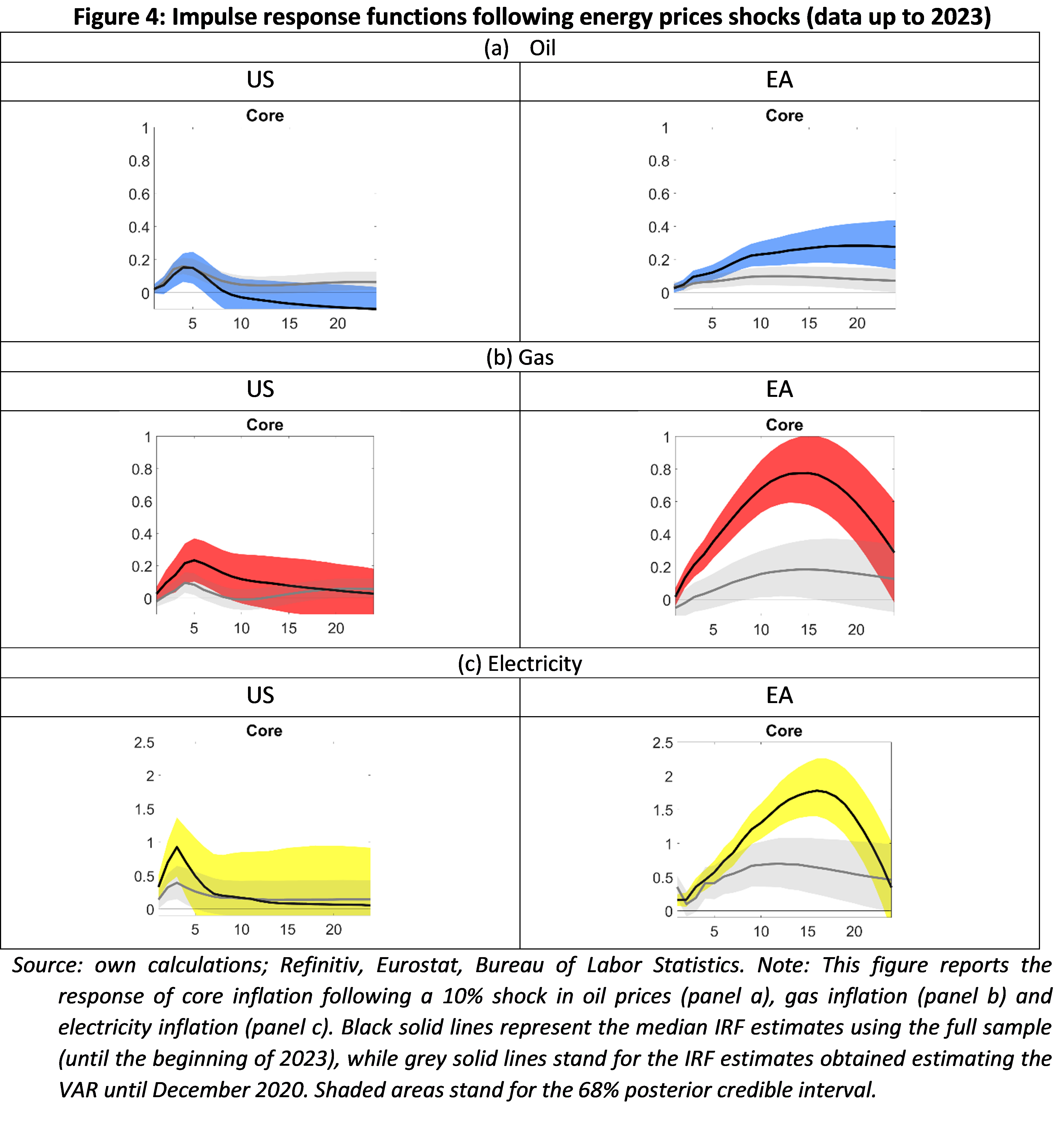

A extra granular evaluation – see Determine 4 – reveals that the sharp enhance within the sensitivity of EA core inflation to vitality costs is usually defined by the stronger sensitivity of core inflation to fuel and electrical energy worth shocks. Our conjecture is that the distinctive dimension of the shock to those prices induced a non-linear adjustment of ultimate costs. This probably displays each the unprecedented dimension and period of the shocks within the EA. The shock to vitality costs within the EA was certainly of historic proportions. For instance, between starting of January 2021 till their peak in the summertime of 2022, spot fuel costs rose by roughly an element of 17 within the EA (based mostly on TTF costs; this compares to an element of three.8 within the US, based mostly on Henry Hub costs). A shock of those proportions is more likely to have triggered some non-linearity alongside the transmission chain within the EA.

This rationalization can be constant, for example, with pricing fashions by which companies face a set price of worth adjustment. Cavallo et al. (2023) present that certainly usually fashions with menu prices “giant shocks journey quick”.[4] Confronted with a shock to their manufacturing prices, companies must resolve whether or not to reset optimally their worth and pay the menu price, or to go away costs unchanged at the price of decrease income. The latter different grow to be much less and fewer interesting the bigger the shock is, and due to this fact the extra distant the precise worth from the revenue maximizing worth is.[5]

Two conclusions emerge from the evaluation. First, core inflation within the US is unlikely to learn from the normalization of vitality costs. US core inflation is presently bolstered by the sustained tempo of progress of shelter costs and of the costs of things reminiscent of clothes, furnishings and a few non-shelter companies. It can take time, and doubtless some slack within the labour market, earlier than these costs begin decelerating durably. Second, within the EA there’s scope for a deceleration of core costs because of decrease vitality costs. Within the EA, each items and companies costs are nonetheless influenced by previous vitality worth shocks. As these costs have began to fall they need to contribute meaningfully to cooling down core costs.

[1] US core inflation forecasts for the final quarter of 2023, elicited from the SPF, rose from 2.9% to three.4% between Q2-2022 and Q1-2023. Within the case of the EA, SPF core inflation forecasts had been revised over the identical interval from 2.3 to 4.4%.

[2] Client costs are measured on the premise of the HICP within the EA and of the CPI within the US. For the US, we contemplate a measure of core inflation that excludes the “housing” element. This element has a disproportionate weight in US core inflation (about 40 p.c) and is totally insensitive to vitality costs. It will due to this fact strongly bias downwards the sensitivity of US core costs to vitality costs and warp the comparability with the EA. The index of core inflation web of housing additionally options prominently within the financial coverage debate within the US, as Fed officers and specifically FOMC Chair Powell have typically referred to it as “crucial class for understanding the longer term evolution of core inflation. See “Inflation and the labour market”, by Jerome H. Powell, November 30 2023, accessible right here.

[3] The vitality shock is recognized by assuming – as customary on this literature – that each one the variables within the system could reply contemporaneously to the vitality shock, however that shopper vitality costs reply solely with a lag to different shocks.

[4] Cavallo A., F. Lippi F. and Miyahara Okay. (2023), “Inflation and misallocation in New Keynesian fashions”, ECB Discussion board on Central Banking, Sintra, 27 June.

[5] See additionally Nakamura, E.,and J.Steinsson,‘‘5 Info about Costs: A Re-evaluation of Menu Value Fashions,’’ Quarterly Journal of Economics, 123 (2008), 1415–1464 and J. Vavra “Inflation Dynamics and time-varying volatility”, the Quarterly Journal of Economics, 129 (2014), 215-258.

This publish written Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti.