Does it matter if spreads are dis-inverting as a result of quick yields are falling, or lengthy yields are rising? MacKenzie and McCormick (Bloomberg) say sure. With lengthy yields rising…

If it checked out first look as if the shift within the yield curve was a solidly optimistic signal — one indicating that the economic system is now at much less danger of a recession than it was — that’s most likely not the case. True, it exhibits merchants aren’t anticipating the Fed to shift into firefighting mode quickly. Even so, it’s virtually sure to additional dampen the economic system because it ripples by means of to mortgages, bank cards and enterprise loans. That may tighten monetary circumstances additional, which can be a welcome improvement to the Fed. The chance, although, is that it hits the brakes so exhausting that the economic system stalls utterly.

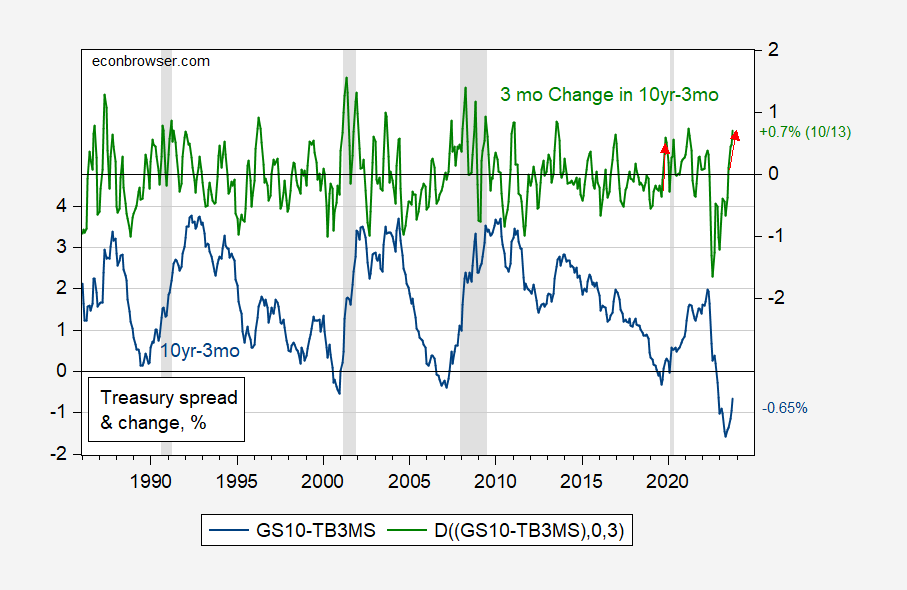

Does having a bull steepening forestall a recession? Determine 1, masking the Nice Moderation, is considerably conducive to that speculation, at the very least eyealling it. h

Determine 1: 10 year-3 month Treasury unfold, % (blue, left scale), and three month change in 10yr-3mo unfold, ppts (inexperienced, proper scale). October statement for knowledge by means of 10/13. NBER outlined peak-to-trough recession dates shaded grey. Crimson arrows when 3 month change is optimistic throughout interval when dis-inversion is going on. Supply: Treasury through FRED, NBER, and creator’s calculations.

The proof in favor of the bear steepening speculation is stronger when evaluating the proposition formally. I estimate probit fashions for (i) unfold solely, (ii) unfold and quick fee, and (iii) unfold, quick fee and three month change in unfold. The three month change in unfold is statistically important and provides to the pseudo-R2.

(ii) Pr(recession=1)t+12 = 0.813 – 76.11unfoldt + 9.80itquick

Pseudo-R2 = 0.28, Nobs = 241, daring denotes important at 5% msl.

(iii) Pr(recession=1)t+12 = 0.736 – 98.37unfoldt + 11.99itquick + 98.28Δ3unfoldt

Pseudo-R2 = 0.34, Nobs = 241, daring denotes important at 5% msl.

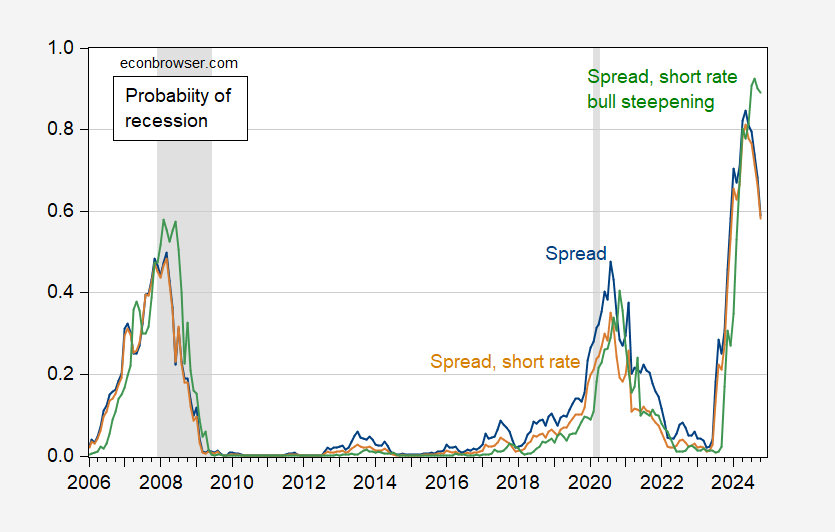

The recession possibilities are proven under.

Determine 2: Recession likelihood 12 month forward estimated over the 1986-2023M10 interval for unfold (blue), for unfold and quick fee (tan), and unfold, quick fee, and three month change in unfold (inexperienced). NBER outlined peak-to-trough recession dates shaded grey. Supply: NBER, and creator’s calculations.

The bear-steepening specification implies 90% likelihood of recession in 2024M09, whereas it’s solely 66.4% utilizing the unfold + quick fee (peak likelihood for this specification is Might 2024). Does this make me extra pessimistic about avoiding a recession? Probably not; the Ahmed-Chinn specification with the international time period unfold (however no steepening measure) was about 90.8% likelihood for September 2024.