Knowledge from 2023Q2 post-revision, and Census building numbers:

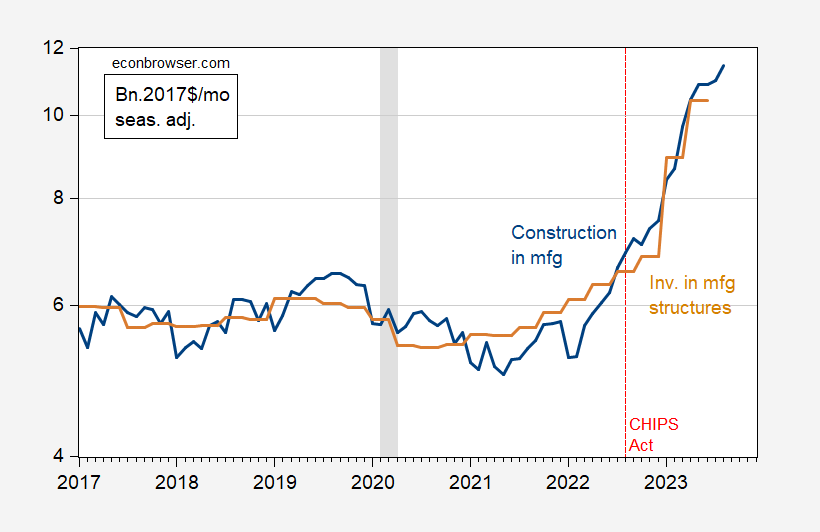

Determine 1: Development in manufacturing, in bn 2017$ per thirty days (blue) and funding in manufacturing buildings, in bn Ch.2017$ per thirty days (tan), each on a log scale. Development deflated by PPI in materials and elements for building. NBER outlined peak-to-trough recession dates shaded grey. Supply: Census, BLS through FRED, BEA (2023Q2 third launch), NBER, and writer’s calculations.

It’s necessary to notice that these information are drawn on a log scale. The bounce in manufacturing buildings funding is much more dramatic if proven in ranges.

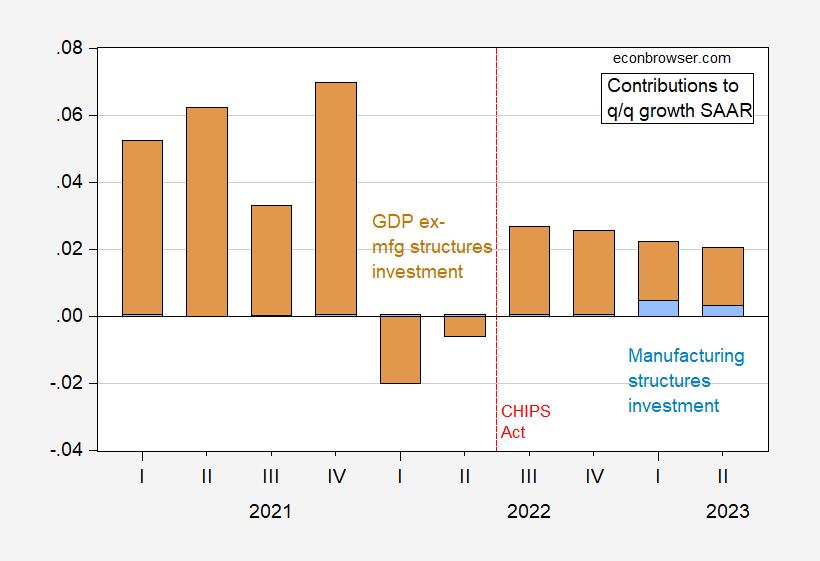

The accounting contribution of funding in manufacturing buildings within the NIPA is sort of hanging in 2023H1.

Determine 2: Contribution to quarter-on-quarter progress at annual fee of GDP from all classes ex-manufacturing buildings funding (tan), from manufacturing buildings funding (blue). Supply: BEA 2023Q2 third launch.

Whereas nonresidential (complete) buildings funding contributed 0.46 ppts of Q2’s 2.1 ppts GDP progress (SAAR), GDPNow as of right now has this elements contribution at 0.02 ppts of Q3 nowcasted 4.9 ppts progress.

So, the CHIPS Act seemingly has spurred nonresidential buildings funding. CBO makes use of a multiplier for transfers to states for infrastructure spending between 0.4 to 2.2. The midpoint of this vary is 1.3. This implies round half a proportion level (at annual charges) of 2023H1 progress will be attributed to the stimulus coming from this measure.

It is a separate concern from whether or not the CHIPS Act, as a sort of commercial coverage, is a good suggestion. These factories nonetheless must be manned, and the chips really produced.