In my MJS article on inflation, I wrote:

Wanting ahead, the inflation surge might be over. The upward strain in rental charges is dissipating, whereas provide chain issues have already disappeared. Lastly, as a result of the Fed has been elevating rates of interest over the past yr and a half, thereby slowing the financial system’s progress, the labor market has cooled considerably, additional stress-free upward value pressures.

That signifies that within the absence of any massive surprises – like one other massive disruption to grease markets – inflation is more likely to proceed to average, though maybe extra slowly than most individuals would really like. Then again, if the Fed has already overly tightened – as the results of previous rate of interest will increase proceed to ripple by way of the financial system – inflation might fall even quicker, though maybe at the price of a recession.

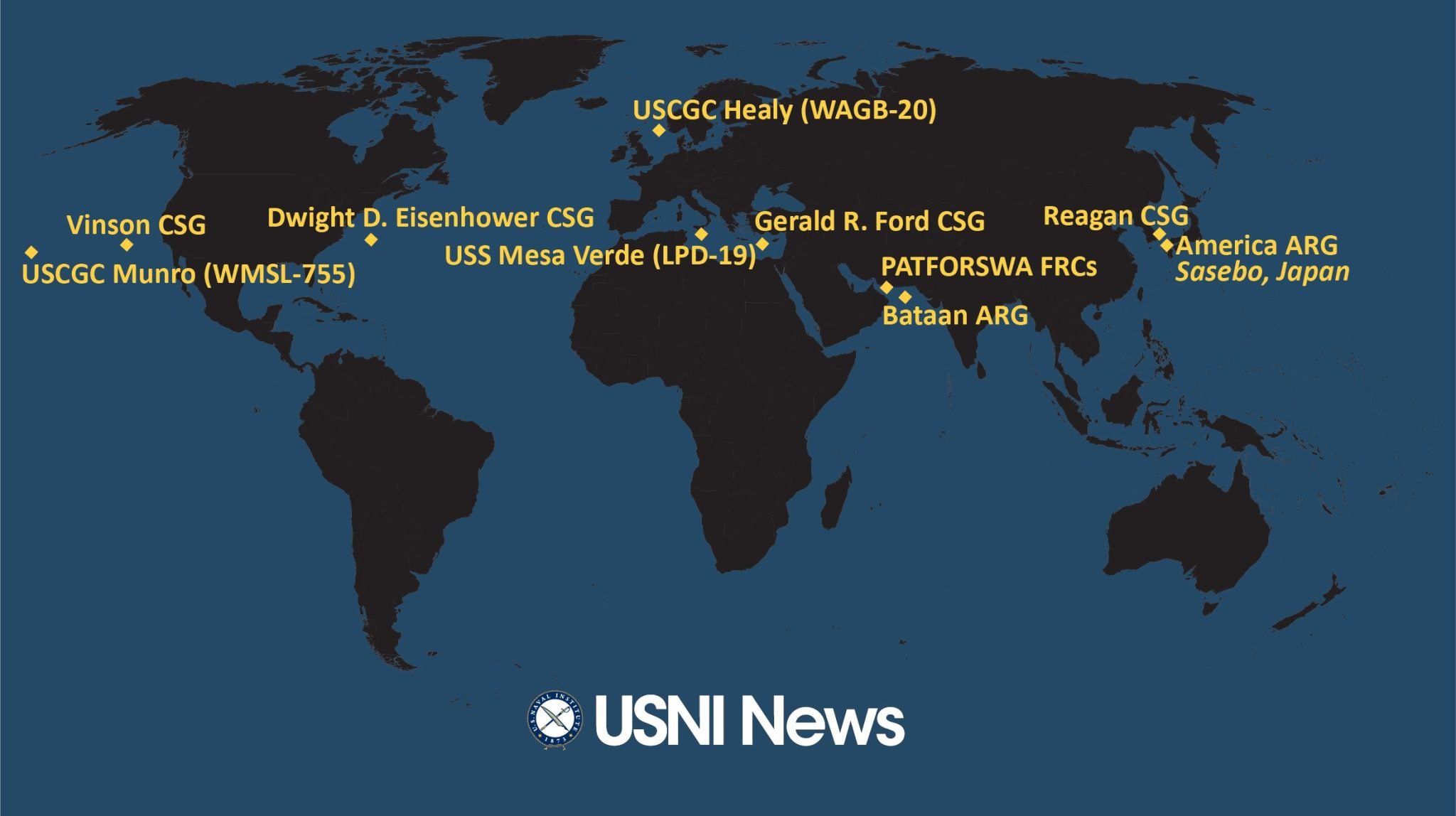

What’s one potential massive shock? Right here’s a graphic:

Determine 1: Map as of October 16, 2023. Supply: USNI.

Eisenhower Provider Strike Group (CSG) to Med; Vinson CSG deploying to “Indo-Pacific”. Bataan Amphibious Prepared Group (ARG) to Jap Med.

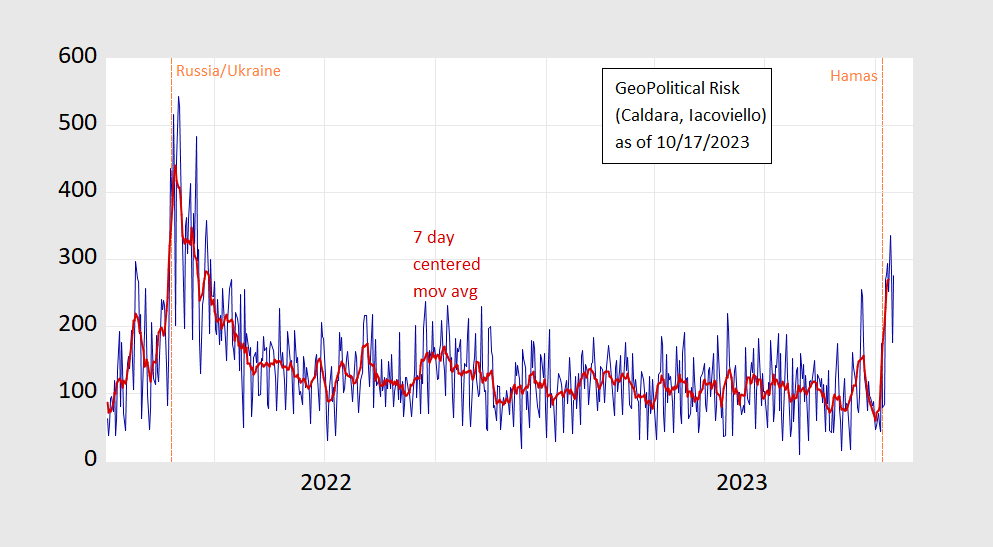

Right here’s one other:

Determine 2: GeoPolitical Danger each day index (blue), and centered 7 day shifting common (pink). Supply: Caldara-Iacoviello, and creator’s calculations.

The GeoPolitical Danger index is elevated, and more likely to stay so. Growth of the struggle to trigger a tightening of oil provides will surely exacerbate inflationary pressures.