12 months-to-date, markets are up – some 12% for the S&P 500, and 28% for the NASDAQ, even after latest volatility and pullbacks. However there’s fear within the air, and the purple flags are flying. A mixture of persistently excessive inflation and rates of interest, together with an more and more harmful geopolitical state of affairs, has an increasing number of consultants calling out warnings.

On the home coverage facet, Federal Reserve chairman Jerome Powell mentioned in latest feedback, “Inflation continues to be too excessive, and some months of excellent information are solely the start of what it can take to construct confidence that inflation is transferring down sustainably towards our purpose.” He went on so as to add that financial coverage just isn’t too tight, a transparent indication that the Fed will keep excessive rates of interest.

In the meantime, Jamie Dimon, CEO of JPMorgan, has sounded a stern warning on the geopolitical entrance. He’s carefully monitoring ongoing conflicts, similar to Ukraine and Russia, intensifying tensions like these between Israel and Hamas, and China’s assertive posturing concerning Taiwan. Dimon says, “My warning is that we face so many uncertainties on the market,” and he closes by reminding us, “this can be essentially the most harmful time the world has seen in many years.”

The confluence of dangers ought to rekindle curiosity in robust defensive performs, notably high-yield dividend shares. These shares supply each safety and passive earnings throughout these difficult instances.

Wall Road analysts appear to concur, as they’ve recognized high-yield dividend payers as engaging buys proper now. Let’s delve into two of those picks: Purchase-rated shares with a minimum of 12% dividend yields.

Hercules Capital (HTGC)

Let’s begin with Hercules Capital, a novel enterprise improvement firm (BDC). What units Hercules aside is its specialised give attention to rising corporations. As a substitute of following the standard BDC mannequin, Hercules primarily affords enterprise debt, offering pre-IPO corporations with a gorgeous different to conventional enterprise capital for funding and financing.

Hercules has been profitable on this area of interest, and over time has compiled a powerful set of statistics. Since its inception, this BDC has funded greater than 600 corporations, to the tune of greater than $17 billion. Within the final reported quarter, 2Q23, Hercules made $541.5 million in new debt and fairness commitments and had $4 billion in belongings underneath administration.

The corporate’s second quarter outcomes confirmed a number of different robust metrics. On the high line, Hercules reported a complete funding earnings of $116.2 million and a internet funding earnings of $75.7 million. Each of those had been firm quarterly information, and the overall funding earnings was up 61% year-over-year whereas beating the forecast by $7.5 million. On the backside line, Hercules’ NII per share, at 53 cents, exceeded expectations by 4 cents per share.

Hercules has seen rising revenues and earnings over the previous a number of quarters and has been rising the dividend in response. The corporate pays each a daily quarterly and a supplemental frequent share dividend. The final declaration, made in August of this yr and paid on August twenty fifth, included a daily dividend of 40 cents per share, which was up 2.6% from the prior quarter, together with a supplemental fee of 8 cents per share. The common dividend yields 10%, and when mixed with the supplemental fee, the overall yield is 12.1%.

For JMP analyst Devin Ryan, who holds a 5-star ranking from TipRanks, Hercules presents buyers with an all-around stable alternative. He writes, “Given Hercules’ place because the main platform and spectacular long-term observe document inside enterprise lending, we anticipate ongoing fairness market volatility will proceed to drive robust demand for debt options (coupled with broader developments inside the banking sector – i.e., banks pulling again on lending, and many others.), finally positioning the corporate even higher long run.”

Wanting forward at that long run, Ryan provides HTGC shares an Outperform (i.e. Purchase) ranking, and an $18 worth goal implies a one-year upside potential of 13.5%. Add within the dividend yield, and this inventory’s one-year return can attain 25% or extra. (To observe Ryan’s observe document, click on right here)

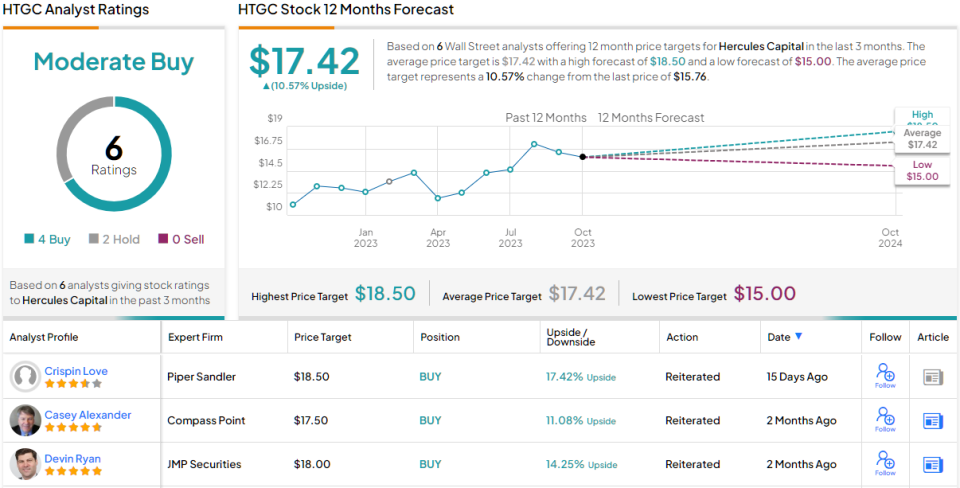

Total, there’s a Reasonable Purchase consensus ranking on HTGC shares, based mostly on 6 latest analyst opinions with a breakdown of 4 Buys and a pair of Holds. The inventory’s $15.77 buying and selling worth and $17.42 common goal worth recommend an upside of 10.5% within the subsequent 12 months. (See HTGC inventory forecast)

Trinity Capital (TRIN)

Subsequent on our listing of high-yielding dividend payers is Trinity Capital, one other BDC. Trinity, like Hercules, works within the enterprise debt phase. The corporate’s portfolio technique is predicated on creating present earnings and capital appreciation by way of its mixture of debt and gear financings, together with equity-related investments and dealing capital loans.

By the numbers, Trinity has made 298 investments since its founding. By the tip of this yr’s second quarter, the corporate’s fundings have totaled $2.6 billion, and Trinity at the moment has $1.2 billion in belongings underneath administration. The corporate’s portfolio at the moment consists of investments in aviation and aerospace, vitality and {hardware}, info know-how and companies, and life sciences.

Digging into Trinity’s most up-to-date reported quarter, 2Q23, we discover that the corporate beat expectations on each revenues and earnings. On its high line, Trinity’s income, reported as complete funding earnings, was $46 million; this was $4.7 million forward of the estimates, and up greater than 37% year-over-year. The agency’s bottom-line internet funding earnings got here to 61 cents per share, 9 cents higher than the forecast.

These outcomes supported Trinity’s robust dividend, which was final set on September 13. The frequent share fee included each a daily and supplemental dividend, with the mixture totaling $0.54 per share. At an annualized fee of $2.16 per frequent share, the mixed dividend yields practically 16%.

The mixture of worthwhile progress and stable dividends caught the eye of 5-star analyst Casey Alexander, from Compass Level. Alexander writes of Trinity, “We anticipate incremental progress will come from rising charges and earnings from the Trinity JV. We see a continuance of dividend will increase as TRIN has a pleasant buffer between the earnings energy and the present dividend. Within the meantime, TRIN’s legacy portfolio has to navigate the VC cycle with out additional misery. Given the pullback in TRIN share worth and the accretive fairness providing, we now choose the danger reward as favorable…”

Alexander goes on to provide Trinity’s inventory a Purchase ranking together with a $15.50 worth goal that factors towards a acquire, over the subsequent 12 months, of ~15%. Along with the dividend, the return right here can exceed 30%. (To observe Alexander’s observe document, click on right here)

Like Hercules above, Trinity’s Reasonable Purchase consensus ranking is predicated on 6 opinions with a 4 to 2 breakdown of Buys to Holds. The shares have a buying and selling worth of $13.54 and the common goal worth, now at $15.25, suggests it has an upside of ~13% for the approaching yr. (See TRIN inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.