Immediately, we’re lucky to have Willem Thorbecke, Senior Fellow at Japan’s Analysis Institute of Financial system, Commerce and Trade (RIETI) as a visitor contributor. The views expressed characterize these of the writer himself, and don’t essentially characterize these of RIETI, or another establishments the writer is affiliated with.

Giant Change Price Appreciations

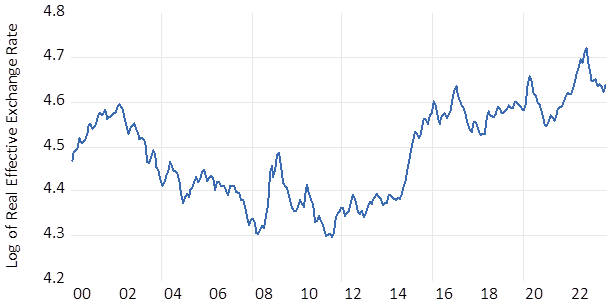

Change charges can admire considerably. The U.S. actual efficient change fee (REER) appreciated 34% between July 2011 and September 2023 (see Determine 1).[1] The Swiss REER appreciated 36% between October 2007 and September 2011. The Japanese REER appreciated 38% between July 2007 and January 2012. The British REER appreciated 27% between January 2009 and August 2015.

Determine 1: U.S. Actual Efficient Change Price. Supply: Financial institution for Worldwide Settlements.

Giant appreciations erode the value competitiveness of exports and trigger dislocation. The Swiss Nationwide Financial institution responded to the appreciation in September 2011 by setting a flooring for the Swiss franc relative to the euro. The yen appreciation decimated the Japanese electronics trade. The pound appreciation crowded out the British manufacturing sector (see Krugman, 2016 and Mody, 2016).

Change Price Elasticities and Product Complexity

How can international locations shield themselves from the dangerous results of appreciations on exports? A technique can be to supply items which are much less delicate to change charges. Abiad et al. (2018) and Asia Improvement Financial institution (2018) famous that subtle items are tougher to supply. There’ll thus be fewer substitutes for these items and prospects might want to spend extra effort and time to seek out replacements. When there are fewer substitutes, microeconomic concept teaches us that value elasticities can be decrease. Thus exports of advanced merchandise could also be much less delicate to change charges.

Abiad et al.(2018) and Asia Improvement Financial institution (2018) really helpful measuring product complexity utilizing the strategies of Hidalgo and Hausmann (2009). Hidalgo and Hausmann employed the tactic of reflections to calculate a product’s complexity. This method takes account of how ubiquitous a superb is, as measured by the variety of international locations which have a revealed comparative benefit in exporting the great. This methodology additionally takes account of how diversified an financial system is, as measured by the variety of items that the financial system exports with revealed comparative benefit. Hidalgo and Hausmann used an iterative course of involving product ubiquity and financial system diversification to derive a product complexity index (PCI) for greater than 1,200 merchandise disaggregated on the Harmonized System (HS) 4-digit stage.

Arbatli and Hong (2016) employed Hidalgo and Hausmann’s (2009) PCI to analyze whether or not extra subtle exports from Singapore have decrease change fee elasticities. They used annual information disaggregated on the HS 4-digit stage over the 1989 to 2013 interval. Additionally they used a imply group estimator and located that merchandise which are extra advanced are much less attentive to change charges.

Sauré (2015) investigated how change charges impression Switzerland’s commerce in pharmaceutical and non-pharmaceutical items. Pharmaceutical items are subtle and require intensive analysis and growth. He employed annual panel information on Switzerland’s commerce with 24 companions over the 1988–2007 interval. He used Arellano-Bond estimation and reported that an appreciation of the Swiss franc had no impression on Switzerland’s commerce steadiness in pharmaceutical items however lowered Switzerland’s commerce steadiness in non-pharmaceutical items.

Baiardi et al. (2015) examined value elasticities for clothes. Clothes is a low-technology good produced by many international locations. They used annual information over the 1992-2011 interval on clothes exports from 12 international locations disaggregated into 4-digit Normal Industrial Commerce Classification classes. They measured relative costs because the ratio of the nation’s export unit worth for every 4-digit clothes class to the common export unit worth for the opposite 11 exporters of the identical good. They employed system generalized methodology of moments strategies and located that value will increase decreased exports for 11 of the 12 international locations. On common, a ten% enhance in relative costs for these international locations would cut back clothes exports by 7.5%.

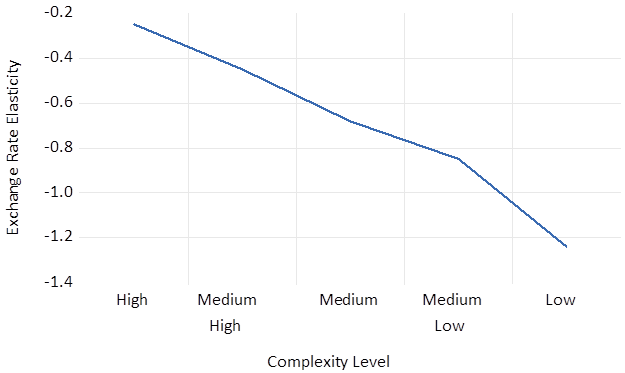

Earlier analysis thus signifies that subtle exports similar to prescribed drugs aren’t affected by change charges and whereas fundamental merchandise similar to clothes are. In latest work (Thorbecke et al., 2021 and Chen et al., 2023), we investigated the connection between product complexity as measured by Hidalgo and Hausmann’s (2009) methodology and change fee elasticities for China, the world’s main exporter. We used Bénassy-Quéré et al.’s (2021) method to estimate change fee elasticities. Thorbecke et al. examined China’s exports of 960 manufactured items disaggregated on the HS 4-digit stage to 190 companions over the 1995-2018 interval. They reported {that a} 10% appreciation of the Chinese language yuan causes a fall in exports of two.5% for essentially the most subtle exports, 4.5% for medium-high subtle exports, 6.8% for medium subtle exports, 8.5% for medium-low subtle exports, and 12.4% for the least subtle exports (see Determine 2). Chen et al. examined China’s exports of 1,242 items disaggregated on the HS 4-digit stage to 190 companions over the 1995-2018 interval. They discovered that appreciations considerably lowered exports through the Nineteen Nineties and early 2000s. Nevertheless, as China has upgraded its manufacturing capabilities and exported extra technologically superior merchandise, its change fee elasticities have fallen.

Determine 2: The Relationship between Change Price Elasticities and Product Complexity for China’s Exports. Notes: Actual change fee elasticities are estimated for China’s exports of 960 manufacturing items disaggregated on the Harmonized System 4-digit stage to 190 international locations over the 1995-2018 interval. The 960 classes are sorted into 5 ranges of complexity utilizing the methodology of Hidalgo and Hausmann (2009). The change fee is interacted with dummy variables for complexity ranges. The regressors additionally embody actual GDP within the importing international locations and importer-product and time fastened results. Supply: Calculations by the authors.

Classes for the U.S.

For the appreciations talked about within the opening paragraph, change charges subsequently depreciated for Switzerland, Japan, and Britain. The U.S. REER, nevertheless, stays sturdy. Current estimates recommend {that a} sturdy U.S. greenback retains regular state U.S. exports decrease and the regular state U.S. commerce deficit greater.

The Atlas of Financial Complexity reported that the rating of the U.S. financial system when it comes to complexity has fallen eight locations between 2000 and 2021 whereas the rating of the Chinese language financial system has risen 21 locations over this era. In line with the Atlas, Japan, South Korea, and Singapore ranked among the many high 5 most advanced economies on the planet in 2021. Traditionally the success of East Asian economies at climbing the expertise ladder and producing subtle items was pushed by components similar to entrepreneurs who face acceptable incentives, employees who’re hardworking and well-educated, fiscal coverage that’s disciplined, nationwide saving charges which are excessive, infrastructure that’s world class, and change charges that aren’t too sturdy. The U.S., to extend the complexity of its exports and to raised climate intervals of sturdy change charges, ought to take a web page out of Asia’s playbook. It must also keep away from coverage mixes similar to expansionary fiscal coverage and contractionary financial coverage that produce giant greenback appreciations.

References

Abiad, A., Baris, Okay., Bertulfo, D., Camingue-Romance, S., Feliciano, P., Mariasingham, J., Mercer-Blackman, V., and Bernabe, J. 2018. The Affect of Commerce Battle on Growing Asia. (Working Paper No. 566). Manila: Asian Improvement Financial institution.

Arbatli, E., and Hong, G. H. 2016. Singapore’s Export Elasticities: A Disaggregated Look into the Position of World Worth Chains and Financial Complexity (Working Paper No. 16–52). Washington, DC: Worldwide Financial Fund.

Asian Improvement Financial institution. 2018. Asian Improvement Outlook Replace: Sustaining Stability Amid Heightened Uncertainty. Manila: Asian Improvement Financial institution.

Baiardi, D., Bianchi, C., and Lorenzini, E.. 2015. The Worth and Revenue Elasticities of the Prime Clothes Exporters: Proof from a Panel Knowledge Evaluation. Journal of Asian Economics 38: 14–30.

Bénassy-Quéré, A., Bussière, M., and Wibaux, P. 2021. Commerce and Forex Weapons. Evaluation of Worldwide Economics, 29: 487-510.

Chen, C., Salike, N., and Thorbecke, W. 2023. Change Price Results on China’s Exports: Product Sophistication and Change Price Elasticity. Forthcoming within the Asian Financial Journal,

Hidalgo, C.A,and Hausmann, R. 2009. The Constructing Blocks of Financial Complexity. Proceedings of the Nationwide Academy of Sciences of the US of America 106 (26): 10570–75.

Krugman, P. 2016. Notes on Brexit and the Pound. The Conscience of a Liberal Weblog, 11 October.

Mody, A. 2016. Don’t Imagine What You’ve Learn: The Plummeting Pound Sterling is Good Information for Britain. Unbiased, 10 October.

Sauré, P. 2015. The Resilient Commerce Surplus, the Pharmaceutical Sector, and Change Price Assessments in Switzerland. (Working Papers No. 15-11). Washington DC: Peterson Institute for Worldwide Economics.

Thorbecke, W., Chen, C., and Salike, N. 2021. The Relationship between Product Complexity and Change Price Elasticities: Proof from the Folks’s Republic of China’s Manufacturing Industries. Asian Improvement Evaluation, 38: 189-212.

[1] REER information come from the Financial institution for Worldwide Settlements.

This put up written byby Willem Thorbecke.