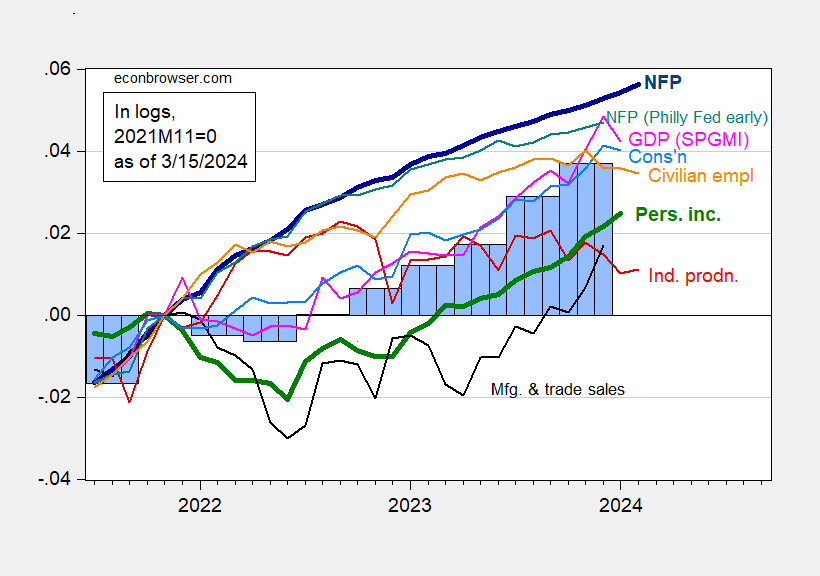

Industrial manufacturing close to consensus, whereas manufacturing surprises on upside (+0.8% vs. +0.3% m/m). Right here’s an image of key indicators adopted by the NBER Enterprise Cycle Courting Committee, together with SPGMI’s month-to-month GDP (previously from Macroeconomic Advisers and IHS-Markit).

Determine 1: Nonfarm Payroll employment from CES (daring blue), from Philadelphia Fed early benchmark (teal), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP, third launch (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2023Q4 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/1/2024 launch), and writer’s calculations.

I embrace the Philly Fed’s early benchmark CES sequence (not the sum of states) as a examine on whether or not the BLS delivery/loss of life mannequin is imparting an excessive amount of job creation to the official sequence (see dialogue in yesterday’s submit).

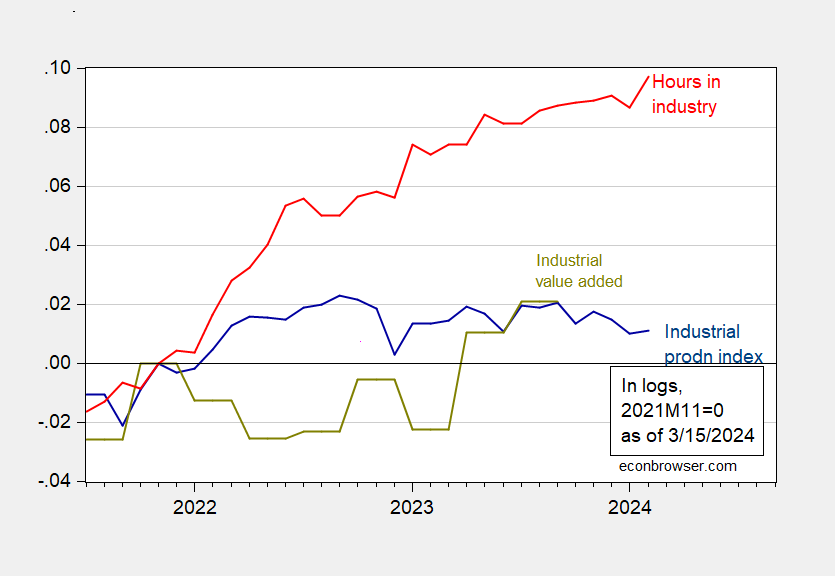

Be aware that industrial manufacturing has been lackluster over the previous yr or so. Industrial manufacturing consists of manufacturing, mining, and utilities. I assumed it of curiosity to see how actual worth added, reported with a a lot higher lag, correlates with industrial manufacturing (which is a gross measure).

Determine 2: Industrial manufacturing index (blue), and worth added in business (sum of producing, mining, and utilities), in 2017$ (chartreuse), combination weekly hours of manufacturing and nonsupervisory employees in business (pink), all in logs 2021M11=0. Be aware: Industrial worth added calculated as easy sum of elements, fairly than utilizing a Tornqvist approximation. Hours for business consists of logging (which is about 7% of employment in mining and logging). Supply: FRB, BLS through FRED, BEA, and writer’s calculations.

Trade worth added and manufacturing index have moved in several methods since end-2021, however are roughly on the similar stage relative to 2021M11 as of Q3. Hours have moved up persistently, in distinction.

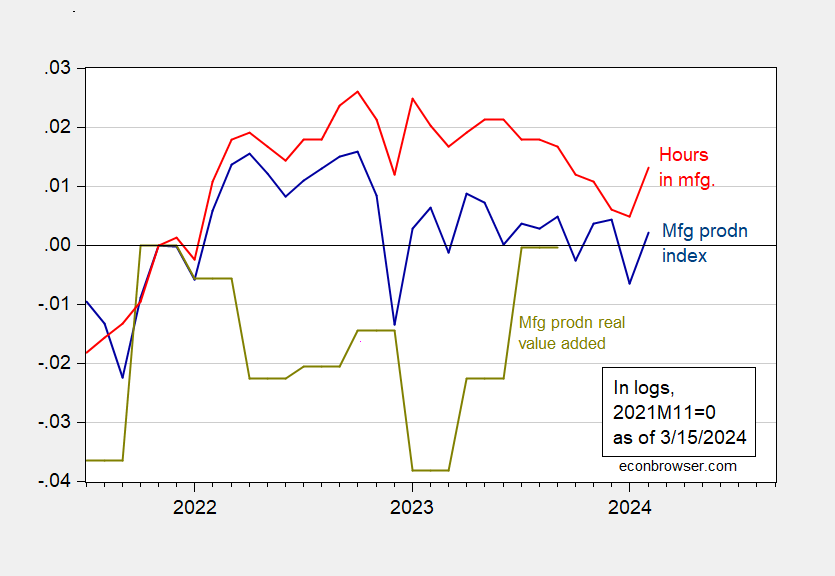

Manufacturing has proven much less divergence.

Determine 3: Manufacturing manufacturing index (blue), and worth added in manufacturing, in 2017$ (chartreuse), combination weekly hours of manufacturing and nonsupervisory employees in manufacturing (pink), all in logs 2021M11=0. Supply: FRB, BLS through FRED, BEA, and writer’s calculations.

Manufacturing worth added did fall over the course of 2022, however has rebounded since, in order that the extent relative to 2021M11 is about the identical as that for manufacturing manufacturing. From a enterprise cycle perspective, the rebound in manufacturing and hours labored suggests the slowdown has moderated (one shouldn’t take an excessive amount of from one month’s knowledge, significantly preliminary).